Returns. That’s what it will always come down to in venture capitalism – the return on investment. That singular goal can be met by lots of different methods, and there’s no sure-fire way to success, but every VC will ultimately be judged by the multiple that they grew their initial capital by.

This had led VC firms, and individual VCs, to look beyond just injecting capital as the way to grow businesses. We’ve seen the rise of Value-Add VC, but today we’re talking about a rapidly growing trend in venture capital – Ethical VCs and the trend towards environmental venture capital. These are the venture capitalists that only invest in businesses and funds that focus on environmental, social, and governance (ESG) issues.

We’re going to look at what is driving this trend, what are the upsides and downsides of ethical investing, and, crucially, do ethical investments provide greater monetary returns?

Table of contents

- Does being ethical increase venture capital dealflow?

- Is the Green Sector the next to experience a boom?

- Will big government back the sustainable venture capital trend?

- Will big government enforce ethical business behaviours?

- Are ESG investments more resilient to shocks?

- Will COVID-19 accelerate the trend towards sustainable venture capital?

- Do ESG focused funds increase return on investment?

- When the tide rises.

Does being ethical increase venture capital deal flow?

Let’s start with dealfow. For any VC, having a healthy pipeline of potential investments is simply a must and any strategy that doesn’t provide that has to be discounted. The first question a VC must ask themselves then, is there enough out there for me to just focus on ethical investments?

Well, one of the main benefits of choosing an ethical VC philosophy is that it cuts out a large swathe of potential investments, immediately giving you more time to focus on the narrower niche you’re targeting.

When we talk about venture capital deaflow, it’s generally in terms of the number of quality potential investments coming through the pipeline, not just the raw numbers, so if you’re able to give more focus on more quality investments over time, then your deaflow should be steady.

Plus, although technology has helped bring investors closer to investments than ever before, VCs still rely heavily on referrals for their next investment – referrals from other investors, from portfolio companies, or from service providers. This means that VCs often create a snowball effect around them; by investing in one company they’re much more likely to attract a similar company in the future.

In other words, a VC known for ethical or green venture capital investments is much more likely to get the first bite of the apple when a prime opportunity comes up. It pays to be a part of the conversation.

While this sort of strategy has been paying off in the tech sector for the last two decades, that has worked because the volume of potential investments means VCs focused in this area have enough dealflow to go around (although it’s still hyper-competitive).

When looking around for the next booming market, the green sector seems ripe for explosive growth over the next two decades, so there should have plenty of venture capital deaflow to compete for. In fact, they already do.

Is the Green Sector the next to experience a boom?

The green sector has been growing fast right across the globe, with exponential growth on the horizon

The green sector is already experiencing a boom and investors focusing on green venture capital are already carving out a lucrative space. By 2018 the green economy was already worth as much as the fossil fuel sector while offering safer opportunities with a greater likelihood of growth.

Green energy is an obvious area where the next mega-firm could come from. Who can solve the problem of storing and distributing solar power efficiently, for example? What fossil fuel giants could see their empire crumble if they don’t act fast? Who will become the Apple to their Kodak?

And this time we’re not talking about the disruption of consumer goods like mobile phones and cameras, we’re talking about the energy companies that power the world.

Veteran New York Times’ tech journalist, Kara Swisher, declared at the start of 2020 that the world’s first trillionaire will be a green-tech entrepreneur. A bold statement at the time, it’s feeling like it might be one that comes true over the coming years.

This is particularly true when aligned with the broader, societal trends we’re seeing, which are being reflected not just in government policy, but how the government is likely to behave in the future.

An example of this is Bloom Energy, a public company that manufactures and markets solid oxide fuel cells that produce electricity on-site. Its share price has risen from $7.88 at the start of 2020 to $36.97 today and is attracting some major players. Why? Because this relatively small company is promising to disrupt the energy market.

Bloom Energy might not end up being the one to do so, but the company that does will see exponential returns for its investors. And, what’s more, they might have significant governmental support in getting there.

Will big government back the sustainable venture capital trend?

In his 1996 State of the Union address, Bill Clinton declared ‘the era of big government is over´, clearly marking the period of history (started in earnest during the 1980s) where governments had stepped away from markets. Light-touch regulation was the stated policy of most Western governments, and big capital and infrastructural investments were left to the private sector.

That may be about to change.

As reported in the New York Times ‘President Biden’s economic advisers are pulling together a sweeping $3 trillion package to boost the economy, reduce carbon emissions, and narrow economic inequality, beginning with a giant infrastructure plan that may be financed in part through tax increases on corporations and the rich.’

Following on from the $2 trillion COVID relief bill passed this year, this sea change in government spending in the US may become the norm across Western powers. While ‘infrastructure week’ became a running gag during the Trump administration this new package is clearly focused on reshaping the US economy into a greener one. And, with this level of investment, we can expect to see regulations follow to ensure businesses get in line behind it.

Those ‘tax increases on corporations’ may well be based significantly on sustainable policies and practices.

What does this mean for VCs? Well, simply put, there will be a) a lot of money going into sustainable industries to boost growth in those sectors and b) those already acting ethically may get a competitive edge over those that would have to implement major changes.

There will be other impacts too. We may see record-high prices of commodities such as energy and metals needed to build this new green infrastructure. When governments change how they act, there are cascading economic impacts across all markets.

Will big government enforce ethical business behaviours?

The era where it was often more profitable to ignore environmental regulations may be ending

At present, environmental regulations are such that many businesses feel the cost/benefit analysis of compliance means that non-compliance is often more profitable, so incentives to be ethical remain weak.

However, that cost/benefit analysis may shift as the true costs of climate change become clearer to the wider public and stronger legislation is put in place to combat it.

The OECD estimates that biodiversity and ecosystem services benefit the global economy to the tune of $125 – 140 trillion per year (i.e. more than one and a half times the size of global GDP). Commercial activities harming this resource could eventually be made pay for the consequences.

This promise of ‘yes, but laws will come’ has been a calling card for the green lobby for decades, but it’s been a largely unfulfilled one up until now. However, with climate change increasingly impacting the economy in more and more direct ways, that calling card may become a clarion call very soon.

Are ESG investments more resilient to shocks?

The prevailing thinking is that operations that have a strong ethical foundation and sustainable practices are more resilient to short, sharp shocks like COVID-19 brought, but also more long-term trends like the move towards more environmentally friendly business practices.

Organisations with these foundations are perceived as more likely to do business ‘the right way’ meaning there will be fewer surprises potentially uncovered when the cash runs low.

BlackRock, the global asset management firm, conducted a major piece of analysis on sustainable investing and concluded:

“Companies with strong profiles on material sustainability issues have the potential to outperform those with poor profiles. In particular, we believe companies managed with a focus on sustainability should be better positioned versus their less sustainable peers to weather adverse conditions while still benefiting from positive market environments.”

2020 saw the biggest global economic shock of our lifetimes with the COVID-19 pandemic, and we saw the lure of resilient ESG investments became more enticing for investors.

Will COVID-19 accelerate the trend towards sustainable venture capital?

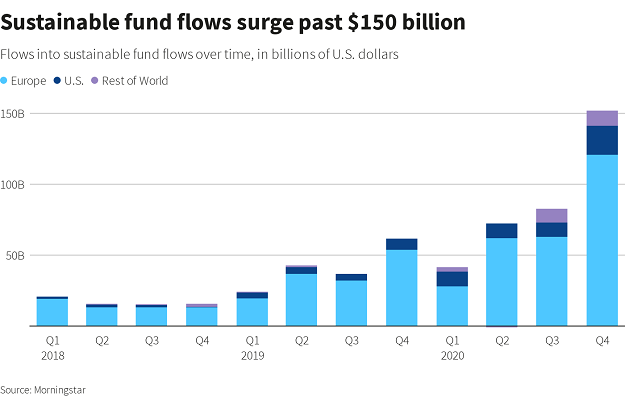

Investments into sustainable funds increased massively in 2021

While 2020 will probably be coined as the year of disruption, it could more accurately be called the year of acceleration. Trends that had been bubbling away for years suddenly came to the fore – the most obvious being remote working, virtual meetings, etc.

The demand to invest in funds that focus on environmental, social and governance (ESG) issues also jumped in 2020. Investment in ESG focused funds rose 29% in the fourth quarter of 2020, for a total of nearly $1.7 trillion.

This level of investment does not come from a collective desire to have a clearer conscience – it comes from seeing the trends in the marketplace and what returns that trend is producing. This brings us to the central question – does ethical investing generate greater returns?

Do ESG focused funds increase return on investment?

The big question, and let’s try to give some clear answers.

There is strong evidence that this type of investing provides better returns, particularly over recent years. An analysis published by BlackRock showed that investment funds considered to be more committed to environmental, social and governance (ESG) issues have fared far better than others so far during the Covid-19 crisis.

Industry analysts, Morningstar, reported 51 out of 57 of its sustainable indices outperformed their broad market counterparts, while index provider MSCI reported 15 of 17 of their sustainable indices outperformed theirs.

Indeed, out of 2,200 studies on ESG, 90% showed either a positive relationship to corporate financial performance (CFP) or at least no negative relationship.

Does this mean ethical investing is a no-brainer for the VC looking for greater returns? Not necessarily.

Firstly, it takes time to build a reputation as an ethical VC, and get the experience required to both to pick the correct investments and support their growth. Secondly, many of the bets being made are over a much longer timeframe than VCs usually work at i.e. an ESG focused fund might be looking for returns in 5 years or more, whereas VCs can often be forced to look at the next quarter.

There are also respected voices in the investment community warning about these ‘win-wins’ and ‘safe’ investments, saying the evidence is not there yet, or conclusive enough, to make such claims.

The firmest conclusion we can come to at present is that ethical investing won’t harm returns, and the evidence seems to suggest it will increase them, but the promises of ‘win-wins’ for everybody are still just that – promises.

When the tide rises

There is certainly an argument for becoming an ‘Ethical VC’ for purely moral and, well, ethical reasons, but that’s unlikely to be a persuasive case for the return-driven venture capitalist. What does make a persuasive argument is the returns ESG focused funds are delivering, the likely ways governments will act over the next few election cycles, and the public demands for changing business practices.

Warren Buffet famously said, ‘only when the tide goes out do you discover who’s been swimming naked’. In future, nearer than we might think, it might be when the sea levels rise that we discover who’s in need of a lifeboat.

Please Note: This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.