ASC 718 Stock Compensation

To formalize the requirements around accounting-related reporting of stock-based compensation, the Accounting Standards Codification Topic 718 Stock Compensation (ASC 718 – Stock Compensation) was introduced in 2009 by the Financial Accounting Standards Board (FASB). It was earlier known as FAS 123 (R).

What is ASC 718?

FASB ASC Topic 718 is a standard that outlines how companies should expense equity awards on an income statement for employees. ASC 718 – Stock Compensation is now expanded to non-employees to reduce the complexity of financial reporting for share-based payments issued to nonemployees.

ASC 718 requires companies to report compensation expenses for equity awards over the award’s vesting period, including share options, restricted share plans, performance-based awards, share appreciation rights, and employee share purchase plans.

ASC is the system that breaks down each rule so it can be easily referenced. ASC topic 718 is one of them and must also follow generally accepted accounting principles (GAAP), which are also issued by the FASB.

Do all companies have to implement ASC 718?

All U.S. public companies and many U.S. private companies should strive to be GAAP compliant. In the latter case, it may not be necessary to incorporate ASC 718 into your financial practices until a Series B or C funding round.

So, it is not unusual for companies in their earliest stages not to implement ASC 718. But, as moving through funding rounds, companies will generally make a point of becoming GAAP compliant as a thorough check of a startup’s financials is mandatory from an investor’s perspective. This is where ASC 718 implementation comes into play.

If you’re seeking to undertake an initial public offering (IPO), then you should carefully consider the following two things:

- There are two simplification provisions included in ASC 718 that are available to non-public entities: ASC 718-10-30-20B and ASC 718-30-30-2A

- Additional recommended disclosures: The American Institute of Certified Public Accountants (AICPA) recommends that financial statements included in a registration statement for an IPO disclose additional information for equity instruments granted during the 12 months prior to the date of the most recent balance sheet (See paragraph 179)

So, how to expense an employee stock option to comply with ASC 718?

The ASC 718 guidelines establish three basic steps for expensing an option:

- Determine the fair value of an option

- Spread the expense associated with the option across its useful economic life.

- Disclose a detailed list of all information you considered, including the methodology of your calculations as well as how you’ll evaluate any future expenses.

1: Determine the fair value of an option

The goal here is to assign a reasonable per-share value for a given stock option award as of the date of grant using accepted accounting principles. It’s worth noting that fair value is different from fair market value (FMV) which is still not yet accepted to be used for calculating the fair value of an option here.

From the accounting perspective, establishing fair value at the outset is important, as doing so will let you know exactly what the option is worth and how it needs to be represented on an income statement. (Note: Restricted stock awards are valued at their fair market value, so the valuation calculation only applies to options)

Observable market prices of identical or similar equity awards in active markets are the best evidence of fair value if available. However, if not available, the option’s fair value can be estimated using a valuation technique or model (sometimes referred to as option-pricing models).

A lattice model (e.g. binomial model), a Monte Carlo simulation technique and a closed-form model (e.g. the Black-Scholes-Merton formula) are among the valuation techniques that are mentioned by FSAB for estimating the fair values of stock options and similar awards. The following requirements are to be met when choosing a technique:

- Consistent with ASC 718’s fair value measurement objective

- Based on established principles of economic theory (see 718-10-55-16)

- Generally accepted by experts

- Capable of reflecting any and all substantive characteristics of the award (except for those excluded)

Whichever model you choose, companies should consistently apply it and should not change it unless a different valuation technique is expected to produce a better estimate of fair value. (see 718-10-55-27)

When applying a technique, you will need to factor in a number of considerations (assumptions) for determining a value, such as expected term, volatility, exercise price, interest rate, dividend yield, and FMV. When all relevant variables are fed into the model, this will yield a value per option figure which will then allow you to move on to the next step.

Global Shares use the Black-Scholes Merton formula, It is considered one of the best ways to determine fair prices of stock options. It is a simple and easily understood model with the assumption that stock prices follow a lognormal distribution.

2: Spread the expense associated with the option across its useful economic life

Now, we’re able to determine the fair value of the option. It’s time to record it in the books. Ways you can allocate the expense:

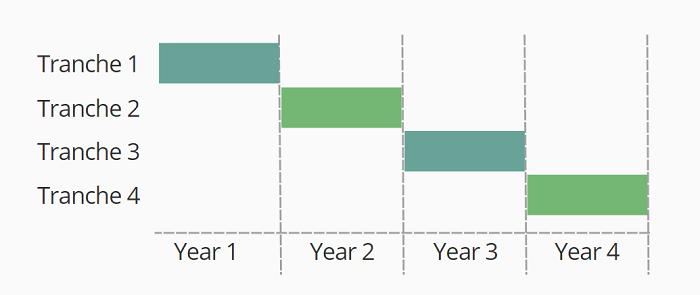

- “Straight-line” method: Allocating the value of a grant evenly over the vesting period to which the grant applies.

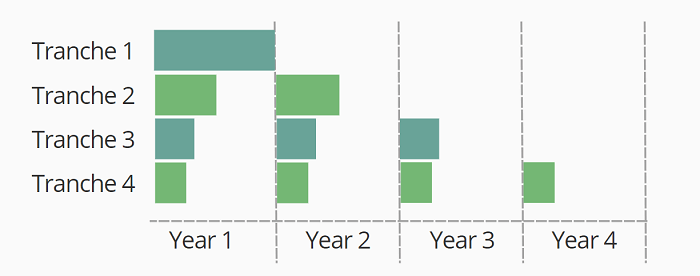

- FIN28 (Accrual) method (also known as front-loaded method): Often referred to as the “ratable” method, this involves the allocation of each tranche in an equity grant separately.

In a ‘’straight-line’’ method, for example, an award with a calculated $1000 fair value vests 25% each year over 4 years. You’ll then record $500 of stock compensation expense each year.

A FIN28 method is also a GAAP-accepted method that front-loads the expenses associated with a grant. So, the expense for each separately-vesting tranche is allocated to earlier periods than to later periods over the service period (i.e the vesting period).

Finally, you must record the expenses associated with the award of equity compensation as expenses in the general ledger, and reflect them in the company’s income statement.

With our software, expenses can be allocated using either the Straight Line or Front Loaded Allocation Model.

3. Disclose a detailed list of all information you considered

As required by ASC 718, you will need a disclosure summary which – put simply – is a stock option balance sheet for your company.

You will want to create a detailed list with all of the information you have collected in the prior steps concerning active grants (including options granted, exercised, forfeited, and expired). This section of your report displays in depth the methodology behind how you obtained your option valuation information at the beginning of your ASC 718 report preparation process, as well as information that will help evaluate your company’s projected expenses in the future.

ASC718 accounting will tend to become more complex over time, especially in some situations where you may decide to change the terms or conditions of your stock option award. For example, if you need to reprice your options, extend the vesting period, or change the terms of a performance condition, you must use modification accounting to remain compliant with GAAP.

This being the case, companies stand to benefit enormously if they look to bring in outside expertise as early as possible, rather than muddle through and become gradually or perhaps suddenly overwhelmed. With a dedicated Financial Reporting team, Global Shares is here to help you stay audit-ready and GAAP-compliant with ASC718 stock compensation expense reporting.

Contact us today and our team of highly qualified experts will be able to assist you through every step of the process.

This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.