What is phantom stock?

Phantom stock is a form of stock-based compensation, sometimes called shadow stock or simulated stock. Phantom stock gives employees the financial benefits of stock ownership without offering them the actual company stock or requiring them to make an investment.

As a type of nonqualified deferred compensation, a phantom stock plan is governed by Code § 409A. Some benefits are receiving corporate tax reductions and deferring income tax to employees until the payment is actually made. This award is used primarily by closely-held corporations.

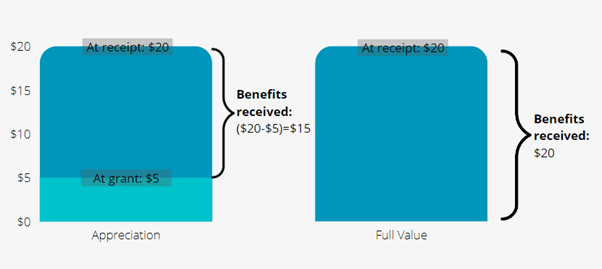

There are two types of phantom stock – appreciation only and full-value.

Appreciation only

When you offer your employees appreciation-only phantom stock, they’ll receive the value above and beyond what the phantom stock was worth at the time of grant. In the above example, the recipients are paid out $15 per share, which is the appreciated value from the grant date.

This type of phantom stock based on appreciation is also commonly referred to as a stock appreciation right.

Full-Value

When you offer your employees full-value phantom stock, they’ll be paid out exactly what it’s worth in full value. In this example, the recipients’ bonus is $20 per share, which is the total value of the stock, rather than the appreciated portion.

How does phantom stock work?

Phantom stock works by following the value of the company’s actual stock, meaning its value rises and falls in line with the company stock’s value.

Recipients are then compensated with profits incurred from the stock appreciation after certain conditions are met (i.e. vesting). They’re typically paid out in cash but could be in shares.

No matter which phantom stock you hold, this delay mechanism – vesting – is usually in place to incentivize employees to stick around. A vesting schedule can be time-based or performance-based. Phantom stock usually vests (i.e. becomes available) in the following situation:

- Upon achievement of performance goals

- Time-based vesting

- Retirement

- Voluntary termination

- Upon a change in control (CIC)

To learn more about vesting, check out our ‘’How does vesting work?‘’ guide.

Phantom stock taxation

Employees:

When shares of Phantom Stock are granted, there is no tax impact on an employee. When the bonus is received in cash, the bonus (value of the award minus any costs – usually none) will be taxed as ordinary income (not capital gains) to the employee. Note: It is also subject to FICA taxes (i.e. Social Security and Medicare taxes) at the time the benefits vest. (Source: IRS Publication 5528 (p.8))

When the bonus is settled in shares, the amount of the gain is taxable at exercise. Any subsequent gain on the shares is taxable as capital gains at the time of sale.

Employers:

At the time the payment becomes taxable to the employee, the company will receive a tax deduction for that payment (Source: IRS Publication 5528 (p.15)). Note: the company is also subject to FICA taxes at the time the benefits vest.

To ensure these tax results occur, the plan has to be compliant with Code § 409A. A violation of the code 409A rules could cause immediate taxation, plus an additional 20% tax, as well as other penalties.

Advantages and disadvantages of phantom stock

Advantages

- Motivates employees and increases productivity

- Does not require investment (i.e. no upfront payment by participants)

- Does not dilute other shareholders due to no actual stock being transferred

- Entitled to corporation tax deduction

- Allows for the deferral of taxes after vesting (i.e. deferred compensation)

- Used as a standalone tool to reward employees or to supplement other equity awards to ameliorate their shortcomings.

- Special forfeiture provisions can be included in the phantom stock plan to eliminate the company’s obligation to make payments to an executive upon specified events

- Permits employees to receive actual shares of stock or cash

- Cheaper to set up

- Suitable for both public and private companies

Disadvantages

- Employers must have sufficient cash on hand to pay benefits when they are due.

- Participants in “appreciation-only” plans may not receive anything if company stock does not appreciate in price.

- Private companies need to pay extra for stock valuation.

Phantom stock vs stock appreciation rights (SARs)

Phantom stock and SARs are similar to each other. Recipients under these plans don’t receive the actual company stock but their financial benefits are tied to the company’s stock performance.

In several ways, they’re different:

- Phantom stock can be in two different forms – ‘’Appreciation only” and “Full value” while SARs only refer to the appreciated portion.

- Phantom stock plans must comply with section 409A because they are nonqualified deferred compensation. SARs can be exempt from section 409A.

- Phantom stock is paid out at specific dates while SARs may not have a specific settlement date. SAR holders can choose when to exercise their SARs between vesting and expiration.

- Phantom stock may offer dividend equivalent payments while SARs would not.

- Phantom stock holders may have voting rights while SAR holders receive no voting right.

Things to consider when creating a phantom stock plan

If you’re convinced that a phantom stock plan is right for you, then consider drafting your phantom stock plan agreement. The agreement should spell out the plan details and how it operates. Things for you to consider are:

- Objectives of the plan

- Eligibility

- How many shares of phantom stock to be granted

- Type of phantom stock to offer: Full value or appreciation only

- How to determine the phantom stock’s value

- Vesting rules – schedule and conditions

- Form of payment

- Section 409A rules: A violation of the code 409A rules could cause huge penalties.

Contact Us

We provide businesses of all sizes with an all-in-one equity management solution at J.P. Morgan Workplace solutions. We handle all the equity award administration so you’ve nothing to worry about. Get in touch to find out how we can assist with equity design and management.

This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.