A non-qualified stock option (NSOs) is a form of equity compensation, often given to employees as part of their overall compensation package. It allows them to become a shareholder in a company and therefore to benefit from its profit and growth. As such NSOs can be used to align employee goals with the overall aims of the company.

What is a non-qualified stock option?

A non-qualified stock option (NSO) is a type of employee stock option that provide employees, as an option-holder, with the right to buy shares of the company’s stock at a set price (the ‘exercise price’ or ‘strike price’) at a future date

NSOs have simpler tax implications and fewer restrictions, but don’t qualify for the favorable tax treatment given to Incentive stock options (ISO). They are usually issued by publicly-traded companies or private companies that are planning to go public at a future date.

Who can get NSOs?

NSOs can be offered to employees and also to non-employees, such as directors, consultants, contractors, vendors, and even other third parties. Eligibility and terms of the options may be decided by the board of directors or a committee appointed by the board.

NSOs are generally given to senior management or executives of a company. In these instances they can behave as ‘golden handcuffs’ i.e. a way to retain key staff. This retention is especially important for businesses in the early stages of growth when looking to compete with established firms for talent.

How do non-qualified stock options work?

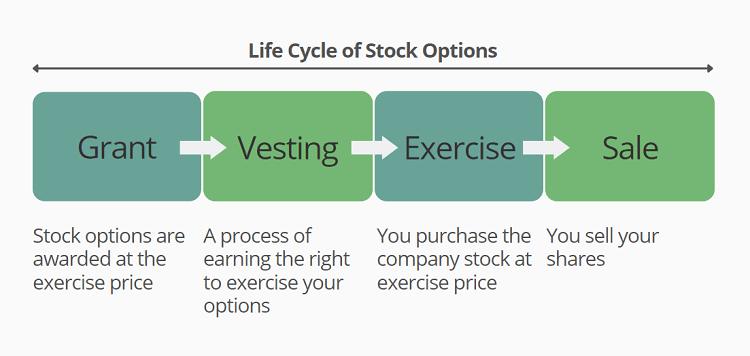

Non-qualified stock options go through four major stages during their life cycle: Grant, vesting, exercise and sale.

1. Grant:

At the grant date, NSOs are offered at a set price (called the exercise or strike price). This price is usually the fair market value (FMV) of the stock at the grant date. No tax is due.

2. Vesting:

Stock option vesting is a process of earning the right to exercise (i.e. purchase) options. The vesting criteria can be time-based (e.g. staying with the company for a certain number of years), or milestone-based (e.g. the company reaches IPO, hits a certain target). No tax is due.

3. Exercise (i.e. purchase):

Once the vesting period has passed, participants then have the right (but not the obligation) to exercise their options at the exercise price until they expire. Note: Some companies allow for early exercise in certain instances, meaning participants can exercise their NSOs before they’re fully vested.

With NSOs, participants pay ordinary income tax when the options are exercised.

4. Sale:

When a holder sells their NSOs after holding them for at least a year of exercising, the gains will be considered long-term and taxed at a lower rate. Otherwise, they’ll likely pay short-term CGT on the gain.

What happens to NSOs if an employee leaves the company?

If an employee leaves the company with vested but unexercised NSOs, they’ll typically have some length of time to exercise their options. They will be taxed at the time of exercise.

If they leave with vested and exercised NSOs, those shares remain theirs. But, there’s a thing to watch out for as the employer may have the right to repurchase the shares.

How leavers and their exercised and unexercised options are treated should be set out in the plan rules prior to implementation.

How are non-qualified stock options taxed?

At Exercise:

At exercise, the NSO spread – the difference between the exercise price and the FMV at exercise – is taxed as compensation. It means the holder will pay ordinary income tax on the spread and will be subject to federal, state and local income taxes as well as payroll taxes. NSOs don’t qualify for the more-favorable tax treatment given to ISOs where no ordinary income tax is charged at exercise.

The compensation will also result in a tax deduction for the company. To learn more NSO tax examples, read here.

At Sale:

At sale, the participant will need to pay CGT on the additional gains – sale price minus cost basis (i.e. exercise price plus NSO spread).

As mentioned already, there are two types of NSO sales – 1) holding shares for at least 1 year after exercising before selling, and 2) selling shares within less than 1 year of exercising. Type 1) has a favorable tax treatment because the rate of long-term CGT is typically lower.

So, why do people sometimes want to sell their assets sooner if that doesn’t result in favorable CGT? Often it’s because they may require the funds immediately, want to secure the profit, cover the exercise costs with the immediate sale proceeds and/or diversify their financial portfolio.

NSOs don’t qualify for the favorable tax treatment given to ISOs but it doesn’t mean they should be undervalued. Their simplicity and flexibility with fewer restrictions can make them a popular equity award.

Request a free demo

NSOs are a type of equity compensation that J.P. Morgan Workplace Solutions manages for companies of all sizes.

Our automated cloud-based equity management software can simplify the process of managing stock options at each stage of their life cycle, saving your team time and effort while improving accuracy.

Get in touch to request a free demo and find out more about how we can help with everything from implementing an NSO or other equity compensation plan, to granting, tracking, trading, tax, compliance and much more in between.

By visiting a third-party site, you may be entering an unsecured website that may have a different privacy policy and security practices from J.P. Morgan standards. J.P. Morgan is not responsible for, and does not control, endorse or guarantee, any aspect

This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.