The world is changing rapidly, but one thing isn’t. Employee ownership is still an effective and popular tool to help companies with recruitment and retention. Offering employee equity can far exceed the financial rewards of just a salary or traditional cash bonuses.

While there are a few different forms of employee equity, employee stock options (ISOs and NSOs) are the most common type. In this post, we’re going to break down the difference between ISO and NSO. Let’s start with the definition of stock options.

- What are stock options and how do they work?

- What is an ISO?

- What is an NSO?

- How are stock options taxed?

- ISO vs NSO: How’re they taxed?

What are stock options?

Stock options are a form of employee equity that gives the recipient the right to purchase (in the future) a certain number of company shares, at a fixed price.

As the stock value rises over time, your fixed price stays the same. After some time (vesting), you can buy (exercise) the stock for a low price and sell it for a future, higher price. To put it another way, options are a way to buy low and sell high.

How do stock options work?

Stock options work by establishing vesting rules that have to be met before a recipient can receive full ownership of the options. After vesting, the recipient can exercise them.

1) Vesting

Whether it’s an ISO or NSO, stock options typically are subject to stock vesting which is a waiting period (time-based and/or milestone-based) where a recipient won’t have full control over the stock option until the waiting period has passed. Once it has passed, the recipient can purchase the company shares and/or sell them for profit.

Vesting makes sense to most companies who don’t want to hire somebody and give them options, only to see them quit two months later. Read our stock vesting guide for more details and examples.

2) Exercising stock options

After vesting, you receive actual ownership of your options. So, you can exercise your options (purchase the shares) at the initially agreed price – a fixed price that is usually the fair market value (FMV) at the time you’re granted. You can also sell them after exercising.

What is an incentive stock option (ISO)?

An Incentive Stock Option, or ISO, is a stock option that is only eligible for employees and always comes with a vesting schedule. It expires 10 years after the grant date.

It qualifies for special tax treatment. This means that you’re not required to pay tax when you exercise the options.

There’re some restrictions for ISOs:

- Employees can be granted up to $100,000 worth of ISOs each calendar year, based on the fair market value (FMV) at the grant date (any excess will be treated as NSOs).

- The exercise price for ISO must not be less than the FMV value at the grant date.

- For significant shareholders (> 10% shareholders), the exercise price must be at least 110% of the FMV, and the ISOs must be exercised within five years after the grant date.

- ISOs can only be granted by an entity that is taxed as a corporation.

What is a non-qualified stock option (NSO)?

A Non-Qualified Stock Option (NSO) is much like an ISO. However, unlike ISOs, NSOs are eligible for any service providers, e.g. employees, consultants, and directors, and may or may not include a vesting schedule. Their expiration is more flexible without a fixed period.

They don’t qualify for special tax treatment. This means that you pay tax when you exercise and when you sell the shares.

As NSOs are non-qualified, they’re unrestricted.

ISO vs NSO tax treatment

Another difference between ISO and NSO is the tax implication.

1) Tax at grant and vesting:

There’s no tax event for both ISOs and NSOs

2a) Tax at exercise:

For ISOs, there’s no tax event* at the time of exercise.

For NSOs, the difference between the FMV at exercise and the exercise price (called bargain element or spread) is taxed as compensation which you’ll need to pay the ordinary income tax on it. So, ISOs are considered more tax-advantaged.

2b) Tax at exercise (when deciding to leave the company):

If you decide to leave the company, you’ll need to exercise your ISOs within 90 days of leaving. If not, your vested ISOs will be treated as NSOs.

In the case of NSOs, there’s no such a 90-day window but you need to exercise before it expires to gain the benefits.

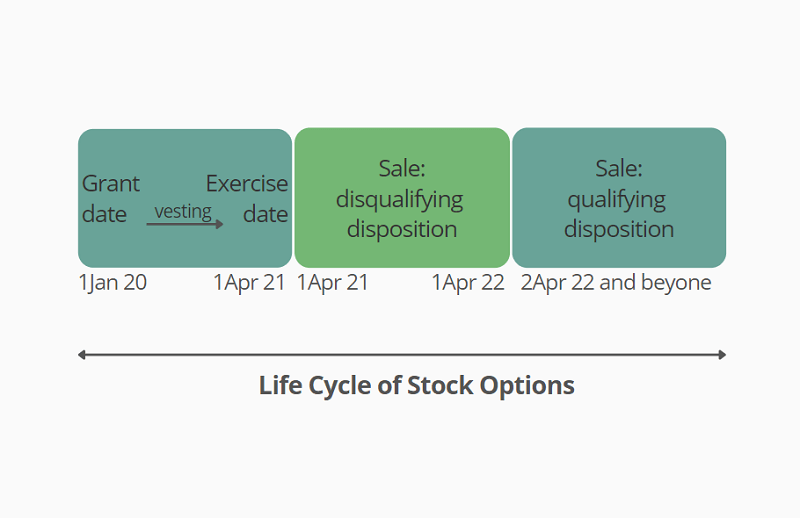

3) Tax at sale:

If you keep your ISOs or NSOs until at least 1 year after vesting and at least 2 years after the grant date, this will be a qualifying disposition and the gains will qualify as long-term capital gains. The long-term capital gains tax (CGT) rate on these gains is usually lower. NSOs are similar when held for over a year after exercising.

If you can’t hold onto your ISOs, they will be taxed more like NSOs and therefore lose the tax benefits. If you can’t hold onto your NSOs, the gains will be treated as short-term capital gains (i.e. taxed at a higher rate typically).

For ISOs, the gain is the amount between the sale price and the exercise price. For NSOs, the gain is the amount between the sale price and the FMV at exercise.

4) ISO vs. NSO tax treatment at a glance:

| ISO | NSO | |

|---|---|---|

| Tax at grant & vesting | No tax event | No tax event |

| Tax at exercise | Typically no tax event (*Note: difference between FMV at exercise and exercise price may result in AMT taxes) |

Spread taxed as ordinary income (i.e. Difference between FMV at exercise and exercise price) |

| Tax at sale | Long-term CGT if held more than 1 year after exercise & more than 2 years after grant | Long-term CGT if held more than 1 year after exercise |

| Exercise following termination | Exercised within 90 days of leaving | Exercised no later than expiration date |

Watch out for AMT when exercising ISO

The Alternative Minimum Tax (AMT*) is a tax that you may owe when you exercise your ISOs and sell them after the calendar year. It’s calculated using a different set of rules. AMT players typically have higher incomes and have to calculate their income tax under 1) ordinary income tax rules and under 2) the stricter AMT rules—and pay whichever amount is higher.

You may wonder why I only pay regular tax each year and never pay AMT. That makes sense if your AMT has been low. However, your AMT can jump significantly to tip the balance when you exercise your ISOs because the ‘’paper gain’’ (i.e. the difference between the FMV at exercise and the exercise price) counts towards your AMT but not your ordinary income tax.

How can I avoid AMT?

- Use AMT exemption amounts: Once you calculate your income under the AMT rules, then subtract the AMT exemption amounts ($75,900 for single individuals for taxes due in April 2023). If your income under the AMT rules is lower than $75,900, you do not have an AMT liability.

- Exercise ISOs and sell within the same calendar year: Although you cannot enjoy the long-term CGT rate that is typically lower, you can avoid AMT (This may trigger you to pay more in taxes). But, if you hold on to the shares, you will need to file an AMT adjustment.

ISO and NSO examples

In January 2019, Michael was awarded 4,000 employee stock options, with a 3-year cliff vesting schedule and an exercise price of $0.50. Whether it’s an ISO or NSO, he didn’t have to pay any tax at the grant date. After 3 years, there was also no tax at the point of vesting.

In February 2022, Michael decided to exercise all his vested options. He, again, didn’t need to pay any tax at the time of exercise if he owned ISOs. But he would be liable for ordinary income tax if he owned NSO.

At Exercise:

- FMV: $4

- Exercise price: $0.5

- Tax:

($4 – $0.50) x 4,000 shares = $14,000)

TIP: To exercise your NSOs early can be tax-efficient because the FMV is likely lower. Some companies even allow you to do so before vesting. That’s why you may not be liable to any tax at exercise when the FMV and exercise price is the same)

(unless you are liable for AMT)

- Sale price: $4.5

- FMV at exercise: $4

- Exercise price: $0.5

- Tax:

($4.50 – $4) x 4,000 shares = $2,000

(taxed as long-term capital gains if selling >1 year after exercising)

($4.50 – $0.5) x 4,000 shares = $16,000

(taxed as long-term capital gains if selling >1 year after exercising and >2 years after grant date)

ISO vs NSO: Which is best?

Before asking this question, there’re some factors to consider, e.g. business goals, the scale of the business, employees’ benefits, and concerns.

Favorable tax treatment for employees would be a key benefit that motivates a company to include ISOs in their equity compensation plan. However, in some situations where NSOs would be preferred to a company, e.g.

- When a company wants a more straightforward stock option

- When a company needs to offer options to non-employees

- When a more flexible stock option (or fewer restrictions) is needed, e.g. no fixed expiration, ability to transfer, no maximum value to be exercised, and no fixed time window for exercising options after leaving

Still unsure about the choice? We can help with that. With an award-winning team of equity compensation experts, we can help guide you through the process, and make sure you pick the best option. Contact us today.

ISO vs. NSO Summary

| ISO | NSO | |

|---|---|---|

| Eligibility | Employees only | Anyone (e.g. employees, directors, consultants, contractors, vendors, and even other third parties) |

| Vesting schedule | Yes | Not necessary |

| Tax implications | More complicated | Simple |

| Tax at grant & vesting | No tax event | No tax event |

| Tax at exercise | Typically no tax event (*Note: difference between FMV at exercise and exercise price may result in AMT taxes) |

Spread taxed as ordinary income (i.e. Difference between FMV at exercise and exercise price) |

| Tax at sale | Long-term CGT if held more than 1 year after exercise & more than 2 years after grant | Long-term CGT if held more than 1 year after exercise |

| Exercise following termination | Exercised within 90 days of leaving | Exercised no later than expiration date |

| Expiration | No more than 10 years from grant | Depends on agreement |

| Limitations | #1) A maximum stock value of $100,000 can be exercised each year #2) Stock option owners who retain at least 10% of the company must pay a premium for exercising #3) Non-transferable, except in the event of the death of the owner |

Very few and depend on agreement |

This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.