An incentive stock option (ISO) is a form of equity compensation – given to employees as part of their compensation package – that allows employees to become shareholders in a company and therefore share in its profit and growth. In this article, we’ll discuss:

- What is an incentive stock option?

- How do incentive stock options work?

- Requirements to Qualify Options as ISOs

- What happens to your ISOs if you leave the company?

- ISO tax treatment at exercise

- ISO tax treatment at sale

What is an incentive stock option?

An incentive stock option (ISO) is a qualified stock option that provides added tax benefits to employees. Unlike common stock, a stock option provides its holder with the right to buy shares of the company’s stock at a set price (the “exercise price” or “strike price” ) at a future date. Read more about employee stock options.

As the stock value rises over time, your exercise price stays the same. So, you buy the stock for a lower price and sell it for a future, higher price.

ISOs are usually issued by publicly-traded companies, or private companies planning to go public at a future date.

Who can get ISOs?

Only employees can get ISOs, unlike NSOs where non-employees can also receive the benefits.

ISOs are normally limited to key employees and senior management or executives of a company. They behave as ‘golden handcuffs’ to keep key staff on board. ISOs are especially important when a business is in start-up mode as oftentimes, companies that are in the early stages of growth are competing with established firms for staff.

Requirements to qualify a stock option as an ISO

Under Section 422 of the Internal Revenue Code, ISOs have a couple of restrictions. If your ISOs don’t meet these requirements, they’ll be automatically treated as NSOs. Some of them are:

- $100,000 limit: Employees can be granted up to $100,000 worth of ISOs each calendar year, based on the fair market value (FMV) at the grant date (any excess will be treated as NSOs).

- Exercise price limit: The exercise price for ISO must not be less than 100% of the FMV at the grant date.

- Rules for significant shareholders: For shareholders with over 10% of the company, their exercise price must be at least 110% of the FMV, and the ISOs must be exercised within 5 years after the grant date.

- Transferability: ISO must be non-transferable, with the only exception being the death of the stock option recipient.

- Plan approval: Shareholder approval of the plan must be obtained within 12 months before or after its adoption

If you prefer a flexible stock option without many restrictions, NSOs will be a better choice. Learn more about ISOs vs NSOs.

How do incentive stock options work?

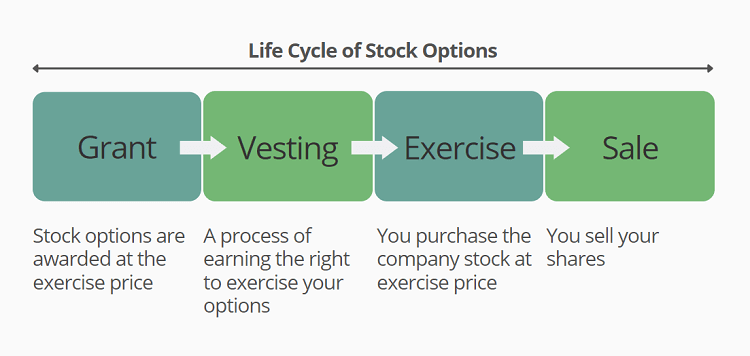

Incentive stock options go through four major stages of equity compensation: Grant, Vesting, Exercise and Sale. We’ll walk through each stage together.

1. Grant:

At the grant date, ISOs are offered to you at a set price, commonly called the exercise price or strike price. The price usually is the fair market value (FMV) of the shares at the grant date. No tax is due.

2. Vesting:

Vesting is a process of earning the right to exercise (i.e. purchase) your options. The vesting criteria can be time-based (e.g. staying with the company for certain years), or milestone-based (e.g. the company reaches IPO). No tax is due.

3. Exercise:

Once the vesting period has passed, you’ll have the right (but not the obligation) to exercise (i.e. purchase) your options at the exercise price. The exercise period of ISOs is limited to 10 years after the grant date typically. Note: Some companies allow for early exercise, meaning you can exercise your ISOs before they’re fully vested.

There’re different approaches to exercise options and factors to consider before exercising your options. Read more.

While ISOs are not subject to income taxation on exercise, the spread at exercise is subject to the alternative minimum tax (AMT). More will be discussed below.

4. Sale:

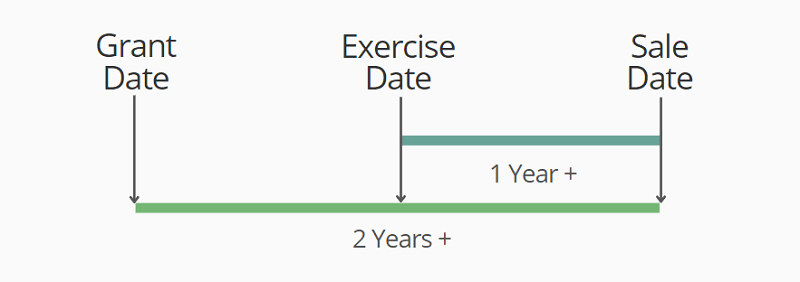

When you sell your ISOs after at least 2 years after the grant date and at least 1 year after the exercise date, you’ll qualify as a long-term capital gain (more tax-favorable). This is called ISO qualifying dispositions.

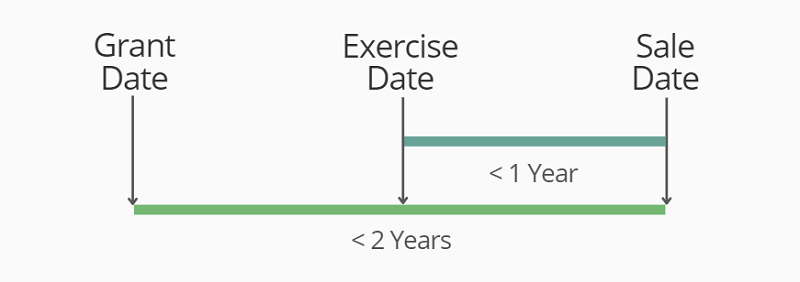

When you sell your ISOs in 2 years or less from the grant date or 1 year or less from the exercise date, this is called disqualifying dispositions. This sale loses tax benefits given to qualifying ISO dispositions. It‘s taxed in two ways: as compensation income (subject to ordinary income rates) and as capital gain or loss (subject to the short-term or long-term capital gains rates).

To simplify the process of managing ISOs at each stage of their life cycle, our automated cloud-based software reduces all past administrative complexities, saving your team time and effort and at the same time improving accuracy. Speak with us now

Contact Us

What happens to your ISOs if you leave the company?

If you leave the company with vested but unexercised ISOs, you’ll typically have 90 days from your last day to exercise your options. If not, your vested ISOs will be treated as NSOs.

If you quit with vested and exercised ISOs, those shares are yours. But, there’s a thing to watch out for – your employer may have the right to repurchase the shares from you.

Before leaving your company, make sure you read your plan documents carefully to understand what might happen with your stock options.

How are incentive stock options taxed at exercise?

No income is recognized for regular tax purposes on exercise, but the ISO spread (the difference between the exercise price and the FMV on exercise) is subject to the AMT when you exercise your ISOs (Source: IRS.gov). You can avoid AMT by selling your ISOs within the same calendar year although you won’t be able to enjoy the favorable long-term CGT.

To determine your AMT liability, you’ll need to compare your ordinary income tax with your tentative minimum tax (TMT). Since AMT is the excess of the TMT over the regular tax, the AMT is owed only if the TMT for the year is greater than the regular tax for that year (Source: IRS.gov). For example,

Case 1:

– Ordinary income tax: $300,000

– TMT: $340,000

Since your TMT is greater than your ordinary income tax (as the result of ISO exercise), you’ll pay an ordinary tax of $300,000 and an AMT of $40,000 ($340,000-$300,000).

Case 2:

– Ordinary income tax: $300,000

– TMT: $280,000

Since your ordinary income tax is now greater than your TMT, you’ll only pay an ordinary tax of $300,000. No AMT will be paid in this case.

Note: Examples given on the J.P. Morgan Wealth Management website

So, How to calculate TMT?

Based on IRS.gov, you can generally compute the TMT by:

- Adding the ISO spread (the difference between the exercise price and the FMV on exercise) to your total income and subtracting AMT eligible deductions = Alternative Minimum Taxable Income (AMTI)

- Subtracting the AMT exemption amount ($75,900 for singles and $118,100 for married couples filing jointly) from (1)

- Multiplying the amount computed in (2) by the AMT tax rates (26% for incomes below $199,900 and 28% if income is above the threshold)

- Subtracting the AMT foreign tax credit = TMT

If your regular tax is higher than your TMT each year, you don’t have to pay AMT. That may explain why some people haven’t heard of AMT. But, if you decide to exercise your ISOs this year and hold on to the shares, you’ll likely get an AMT bill.

How are incentive stock options taxed at sale?

As mentioned, there’re two types of ISO sales – Qualifying disposition and Disqualifying disposition.

1. ISO qualifying disposition:

When you sell your ISOs after at least 2 years after the grant date and at least 1 year after the exercise date, the difference between the exercise price and sale price is taxed as a long-term capital gain or loss. You are not taxed as ordinary income in this sale. In this scenario:

- Grant date: 07/01/2020

- Exercise date: 07/01/2021

- Sale date: 07/31/2022

- Exercise price: $3 x 100 shares = $300

- FMV at exercise: $6 x 100 shares = $800

- Sale price: $10 x 100 shares = $1000

Capital gain:

$1000 – $300 = $700, taxed as a favorable long-term CGT rate

Since the sale and the exercise of the options didn’t occur in the same year, you must have reported an income adjustment (i.e. ISO spread) for AMT purposes in 2021 – the year you purchased the shares.

In 2022 – the year you sold your shares, you will have to report another adjustment for AMT purposes.

Gain for AMT purposes from the sale:

Sale price – (Exercise price + AMT adjustment from the year of exercise)

$1000 – ($300 + $500) = $200

2. ISO disqualifying disposition:

When you sell your ISOs in 2 years or less from the grant date or 1 year or less from the exercise date, you lose ISO tax benefits. So, why do people want to sell their shares sooner rather than hold on to their shares? Because they may want to avoid AMT if they sell within the same calendar year (see in example 2a), cover the exercise costs (see in example 2b), or simply secure profits.

2a) Sell all shares right after you exercise your ISOs

The first part to consider is the bargain element – the difference between the exercise price and the sale price (FMV at exercise). It is taxed as ordinary income and subject to federal, state and local income taxes

- Grant date: 07/01/2020

- Exercise date: 01/01/2021

- Sale date: 01/01/2021

- Exercise price: $3 x 100 shares = $300

- Sale price: $10 x 100 shares = $1000

Part I: Bargain element: $1000 – $300 = $700

The second part is short-term gains since you sold the shares less than a year after exercising the option. It’s the difference between the sale price and cost basis – the exercise price plus the bargain element in part I.

Part II: Short-term gains: $1000 – ($300 + $700) = $0

Since the cost basis and the sale price are the same, you end up reporting no gain or loss on the stock sale transaction itself here. Also, no income adjustment for AMT purposes is needed in this case

2b) Sell share in the next calendar year but less than 1 year after the exercise date

The first part to consider is the lesser of

– The bargain element: the difference between the exercise price and the FMV at exercise, or

– The gain: the difference between the exercise price and the sale price

It is taxed as ordinary income and subject to federal, state, and local income taxes.

- Grant date: 07/01/2020

- Exercise date: 07/01/2021

- Sale date: 01/31/2022

- Exercise price: $3 x 100 shares = $300

- FMV at exercise: $6 x 100 shares = $800

- Sale price: $10 x 100 shares = $1000

Part I: Bargain element: $800 – $300 = $500 ; Gain: $1000 – $300 = $700 ; So, bargain element is taxed

Any additional gain is taxed as a capital gain – the difference between the sale price and cost basis – the exercise price plus the bargain element in part I

Part II: Short-term gain: $1000 – ($500 + $300) = $200

In this case, when you originally purchased the stock, you should have reported an income adjustment ($800 – $300 = $500) for AMT purposes in that year. You will have to report another adjustment for AMT purposes in 2022 – the year you sold your shares.

ISO tax summary

| Grant | Vesting | Exercise | Sale |

|---|---|---|---|

| No tax | No tax | Alternative Minimum Tax (AMT) if selling shares in the next year. No regular income taxes |

Long-term CGT for an ISO qualifying disposition. Income taxes and short-term CGT for an ISO disqualifying disposition |

Request a free demo

ISOs are a type of equity compensation that Global Shares manage for companies all over the world. Request a free demo to find out more about how to plan and administer ISOs and our other products and services.

Request a Demo

This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.