Every startup should have a Cap Table which gives the founders and other interested parties a snapshot of the ownership stakes in the company. This information can help you understand who owns what, when it comes to raising funds, attracting investors etc. So, how do you create a Cap Table? Two options are by using:

- A spreadsheet template; or

- Cap Table management software

Here, we’ll spell out the pros and cons for each solution, as well as links to some FREE, ready-to-use tools.

Cap Table Spreadsheet Template

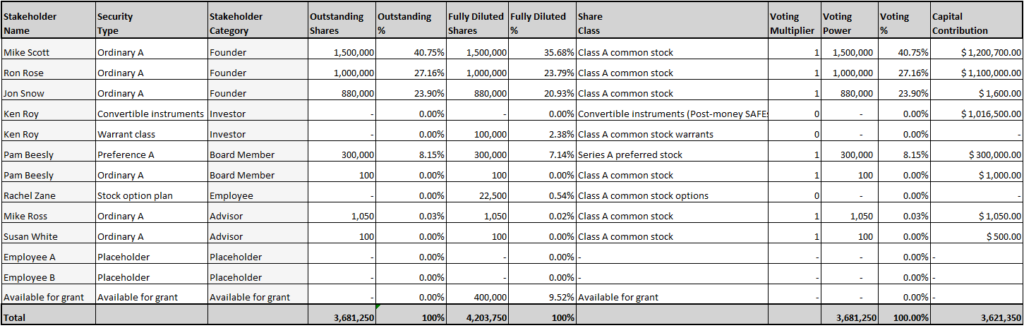

When a company is young, and at its most basic, a Cap Table is often an Excel spreadsheet which can be fine to start with. It will typically contain stakeholder names, ownership details for each stakeholder (e.g. what type and how many do they own), issue date, details of unissued shares, etc.

How to create a Cap Table from scratch in a spreadsheet?

Creating and managing a Cap Table on a spreadsheet is a manual process. If it’s your first time building a cap table, you can simply use this simplified, beginner Cap Table template to get started.

PROs:

✓ Easily accessible

✓ Low setup cost

✓ A good learning experience to understand how a Cap Table works from its earliest version

✓ Ideal for (very) early-stage startups

CONs:

✖ Prone to human error (e.g. incorrect data entry) and inconsistent data (e.g. date format)

✖ Expensive and time-consuming to resolve human and formula errors, inconsistency and formatting issues

✖ Labor-intensive to manage and maintain the data via re-writing and verifying formula even without error

✖ Difficult to scale with you after a few rounds of financing and hiring more employees

✖ Causes multiple file versions circulating internally

✖ Low level of employee engagement

Cap Table Management Software

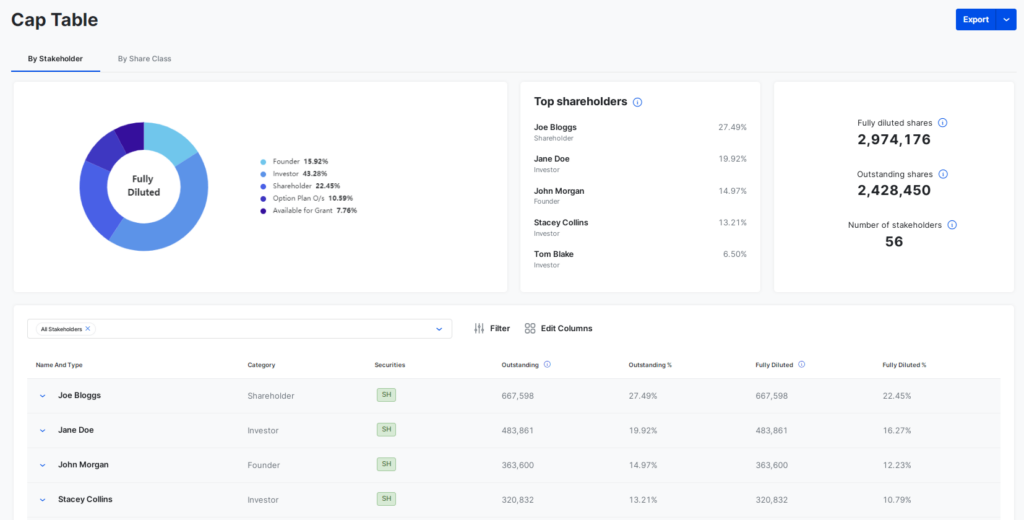

Companies will often shift to Cap Table management software soon after they become aware of the issues associated with their spreadsheet. Using a software solution effectively builds an up-to-date, clean Cap Table online for you and your investors.

It updates accordingly as ownership or financial changes happen, removing the time-consuming and error-prone manual update component for you. Software like Global Shares’ Cap Table can also help you stay compliant regarding audit checks.

Sign up for Global Shares Cap Table Software now

(Free for up to 100 stakeholders)

PROs:

✓ Always provides your co-founders, lawyers and investors with a single source of truth

✓ Removes inconsistency and formatting issues, as well as human and formula errors

✓ Easily issue shares, track ownership, create new equity plans and manage plan rules (e.g. termination and vesting)

✓ Offers personalized employee and investor online portals to increase engagement and visibility

✓ Able to model an upcoming funding round to help you understand its impact

✓ Helps your company stay compliant during audits

✓ Provides access to extra services, e.g. 409A Valuation and ASC 718 Equity Compensation Expense Reporting

✓ Provides customer support

✓ A scalable solution as you grow

✓ Free plan available

CONs:

✖ Takes some time to find the right cap table management software

✖ Paid plan needed when your company expands

Contact Global Shares, a J.P. Morgan company, today

We can work with you to simplify your Cap Table management. Not only do you get benefits from our software, but also a customer success manager who can assist you with complex issues of your Cap Table, provide software training and help you connect with top global advisors for share plan design and 409 valuations etc.

Contact Global Shares today to find out how we can help you set up or organize your Cap Table.

By visiting a third-party site, you may be entering an unsecured website that may have a different privacy policy and security practices from J.P. Morgan standards. J.P. Morgan is not responsible for, and does not control, endorse or guarantee, any aspect of any linked third-party site. J.P. Morgan accepts no direct or consequential losses arising from the use of such sites.

Please Note: This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.