Building a startup is an exciting time; a time of opportunity and innovation. Ambitions are high and the future is full of potential. It’s also a time where many challenges can arise and mistakes can be made; mistakes that can have a considerable impact on your business further down the line.

We’ve worked with multiple startups from all around the world, so we know first-hand the uphill battle that many founders face in their early years.

And we’ve seen the many mistakes that they make – the same ones repeated time and time again.

These mistakes can lead to significant legal complications, the majority of which can be easily avoided with the right legal help. The main issue is not having this expertise from the very beginning.

You may be a founder with a life-changing idea, but without the right guidance, you could be stuck spending your time fixing the issues you once overlooked. And your revolutionary idea, well it just never gets off the ground.

Mistake #1: Not having a crystal clear business deal with your co-founders

One of the most common startups mistakes happens during the formation stage when the business deal is not made clear with co-founders (if any). Issues like equity distribution, ownership and roles and responsibilities may seem minor at the beginning when you are focused on developing your idea, but these can have a real impact on your business in the future. It’s important to get these terms outlined, in a legal contract, from the very start. Just look at Facebook; a Zuckerberg v Winklevoss show-down is something you should want to avoid.

Mistake #2: Ignoring important tax considerations

We’ll be the first to admit – tax can seem confusing, but it’s vitally important that you stay tax compliant, or you could end up facing unexpected tax penalties. Typically, startups make mistakes in the following tax areas:

- Incorrect stock option price: Stock option plans are an extremely popular way of attracting, motivating and retaining employees, especially when you’re unable to pay a market rate salary, which is usually the case with startups. A stock option plan lets you award stock options to key employees, giving them the opportunity to buy stock in the company when they exercise their options. But first, to set up a stock option plan, the company needs to determine the market value of its stock to set the exercise price of the option. Without the help of a third-party expert, this can be calculated incorrectly, leaving the company at risk of massive fines and significant legal consequences.

- Failure to file a Section 83b election: With a Section 83b election, you can mitigate potential future tax obligations. The information you provide by filing for one determines whether any future proceeds from selling stock are subject to long-term capital gains tax. If you fail to submit one, you could be facing a larger tax bill than necessary, as the proceeds from selling stock would be taxed as income rather than long-term CGT. The filing process is complex and requires expert guidance and input. Many startups forgot the appropriate legal support and end up missing out on substantial tax savings.

Mistake #3: Messy equity compensation management

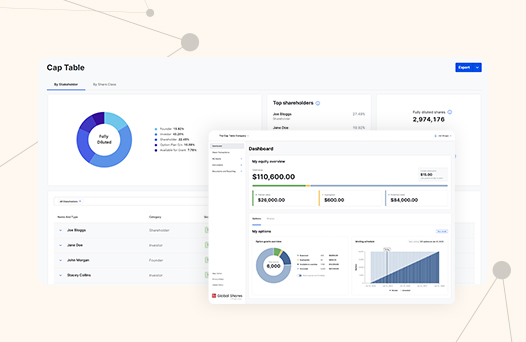

If you’ve got the above sorted, then great. The next thing to focus on is your cap table.

Your cap table shows your market value and the distribution of your equity. Not only is it important for your internal discussions – you need to decide how much equity to give future employees, and where it comes from – but it is also your first chance at a good impression with a potential investor. For many startups, it’s just a document or spreadsheet. But things get complicated quickly. You’re going to have to incorporate things like share issuances, conversion from debt to equity and transfers. As your company continues to grow and your equity distribution continues to change, your cap table can become a disorganised, inaccurate mess – which is a legal and compliance nightmare. Not only does this look bad to potential investors, but it also means a lot of time and money is spent on cleaning things up. Getting your cap table right from the beginning gives investors a clear insight into the breakdown of your equity, and future-proofs your company against any legal challenges that might arise over time.

Mistake #4: Choosing the wrong type of legal support

Startup law is a niche and choosing the right law firm to work with could be the most important decision of all. There are plenty of law firms out there and it can be difficult to know where to go. Additionally, as you start to gain market recognition, the more legal issues you can become vulnerable to. From wrongful termination claims and intellectual property challenges to dissatisfied customers seeking legal recourse and potential trademark claims. When these types of issues come up, you need a legal advisor that you can trust. Plus, when you eventually reach the stage when you want to go public, it pays to have a solid relationship with a law firm that knows your equity inside out.

Get it right from the start

This is where Global Shares can help. We connect startups with the right law firm from the very beginning, while also working with them on their equity compensation management.

Other providers take a one-size-fits-all approach, which doesn’t reflect the reality of the complex issues emerging companies face. At Global Shares, we believe you shouldn’t take on a high growth journey without trusted advisers by your side. We work with your legal and tax advisors from seed stage right on through to your IPO.

We understand the value of your company’s equity and we’re there to mitigate any risk of error. Down the line, when you want to realize that value, our platform will have all the history and evolution of your company’s equity – making due diligence simple and ensuring your employee’s benefits are protected. If you’re a start-up with ambition, make the investment that will safeguard that ambition — and your company — for years to come. Get in touch with us today.

This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.