The dating game is often a game of ‘spot the red flag’. Everyone puts their best foot forward in those early days, showing the most idealised version of themselves and possibly keeping any bad habits in the background.

If you’re a Venture Capitalist (VC) you can probably already see where we’re going with this – you and your potential investments can act just the same.

Because it’s easy to be temporarily blinded by a great pitch, or get caught up in a pulsating narrative, many VCs have their list of red flags to check against to make sure they don’t jump in without seeing the warning signs.

Every list will be slightly different, and rarely does the existence of a single red flag signal the end of the deal, but once they start mounting up, they’re hard to ignore.

What makes it even more complicated is that you’re not necessarily looking for one perfect partner, you’re looking for deal flow. You’re searching for companies where it’s worth committing to due diligence (an often long and costly procedure) and when there are too many obvious red flags and warning signs you’ll move on to the next one.

Here are some of the top ones we think VCs should watch out for prior to parting with their cash.

An unbalanced founder team

Getting the right balance on the founding team will be fundamental to any success (Picture source)

The initial founding team, and how it is made up, will tell a lot about the future of a company. On the one hand, if there’s a single founder, it can point to a lack of diverse opinions at the top or even an overinflated ego that doesn’t want to be challenged. On the other hand, too many founders can lead to a dissolution of equity, motivation and accountability.

And that’s just the number of founders. What are their abilities and knowledge in the area? If they are from a tech background but are launching an FMCG (fast-moving consumer goods) product, do they have any experience in logistics? Are any of them technical-based founders? Without technical knowledge in the initial team, bringing it in could be costly. Having to outsource for a key component of what it will take to make a success of a startup means higher outgoings than if the expertise lies within the founders.

A perfectly balanced founding team will be rare but knowing what one looks like will help correct an imbalanced one.

Badly defined roles

Who is in charge? Who’s the CEO of a company? If you head into a pitch meeting and the founders are confused about this or haven’t had the conversation, this can be a red flag.

While the early days of a start-up can see everyone pitching in on all sorts of areas, without clearly defined roles who really has the responsibilities? Without clear direction, strategy and having someone who is answerable to the decisions being made, is a company on the most straightforward path to success? And if everyone is in charge, is anyone really in charge?

High levels of salary at the top (or looking for a quick exit)

If the CEO and top team are taking a salary above what you’d expect from the corresponding incoming revenues, it could be a big warning sign.

This is an obvious harbinger of a bad outcome for a VC. If founders are taking too high a salary, or seem to be pushing towards a quick exit, then their motivation and drive for the business might be lacking too.

Someone who is committed and in it for the long haul knows that the long game is not always easy. Taking a lower salary at the beginning because they believe in the company and know its potential into the future can be a good sign that the founders and those at the top table in a company, are committed to making it work in the long term.

Highly diluted at an early stage

When a company is already highly diluted at an early stage, a number of questions are raised. For example, if the founders are only left with a small percentage after your investment, will they be motivated enough to achieve the targets you need for a profitable exit?

For series A, typically the founding team will still hold a significant portion of the company after the round — perhaps around the 40–50% mark. But if at this point they’ve already given away a huge chunk of the company to mom and dad or whoever helped them with funding in the early days, there might not be much of the pie left at all. Having a clear, transparent Cap Table is key.

Not knowing or acknowledging the competition

Every business has competitors. Any founder telling you they have no competition either aren’t aware that they have competition or is trying to hide it. Either way, it’s not a good look. A company trying to hoodwink you into thinking they’re the only kid on the block is a red flag. Either they haven’t done their research or they’re not being honest. Neither is a good sign.

The total available market (TAM) isn’t there

Not having a clear grasp and evidence on the potential total available market (TAM) will leave serious doubts about the ability of the business to grow and scale. Smaller and sustainable but low-profit and low-growth businesses are unlikely to be the sorts of investments top VCs will look for.

The size of the market, the dynamics, who the competitors are all matter in terms of the potential for building a big company. Having a limited market means there are limitations to the size that the company will grow to.

High turnover of staff

Talented staff are difficult to replace, and a high turnover of staff during the early stages may be a warning sign for lots of things going on in a company. Firstly, the cost of replacing staff is significant – around a 1/3 of an employee’s annual salary – and a high turnover is a drain on revenues.

Secondly, and maybe more importantly, it could point to a broken culture within the company. It’s estimated that 60% of people don’t leave their jobs, they leave their managers, so high turnover can be a sign of poor management.

Founder behaviour

Lots of VCs will monitor the founder’s behaviour as closely as the finances. How they treat others, how they take advice on board, how they interact with the VC and their team… these behaviours are all hints at how the founder will act under stress – something that is bound to be a common occurrence in a growing start-up. Having a relationship with founders is super important and clashing personalities will get people nowhere fast.

Take Chris Sacca for example. He has invested in companies like Twitter and Uber through his venture capital firm Lowercase Capital and he won’t invest in a company unless the founder is willing to do their own dishes.

While it can be difficult to judge people’s personalities from a few meetings, there are always a few hints. High turnover, mentioned above, can be a sign. Have they ever had a mentor? Are they good at listening or taking advice? Ask the questions, check out references.

Not sharing their Data Room

A well organised, up-to-date data room is a big green flag for potential investors. Being able to access information on previous funding rounds, projected revenues, KPIs, and all the other factors that need to be reviewed during a due diligence process will point towards a well-organised founders team and company in general.

On the flip side, a founder team not willing to share access to their data room brings up more trust issues.

A small customer base (either one customer or loads of free customers)

Being overly reliant on one major customer or having lots of free sign-ups but no regular fees is a classic warning sign. It may be too early in the company’s lifecycle to have a broad base of customers, but exciting financial figures based on these few pillar clients can evaporate quickly.

A broader base of clients is needed both for sustainable revenue and to generate real feedback to improve the offering.

They don’t talk to their customers

Especially in the early days of a business, getting feedback from customers is the most efficient way to improve. You should be looking for companies with continuous feedback loops to their customer base, and the technical ability to act on what they learn.

No products or services are perfect, particularly in their early days, and VCs are more looking for how founders deal with problems rather than trying to discover them. As Reid Hoffman, billionaire venture capitalist famously said, “If you’re not embarrassed by the first version of your product, you’ve launched too late.”

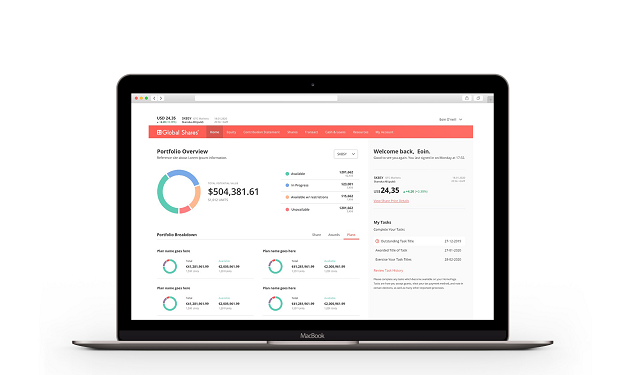

An unclear Cap Table

A clean, stable and transparent cap table (like Global Shares’ platform – seen above) is a must-have for growing businesses

This is one of those fundamentals that need to be right. A lot of VCs will find mistakes on a Cap Table and, at best, they will slow the due diligence process down and probably require legal fees to sort it out.

At worst, a poor Cap Table will leave you unclear who owns the company exactly, what stake their investment would be worth, and how they could exit. In other words, you wouldn’t know what your actual investment is.

Investors should always pay close attention to the cap table and any potential issues with them. Are there red flags that could cause problems in future rounds?

Been fundraising for a long time

If they’ve been raising for a long period of time, why have other investors backed away? For every ‘this man missed out on signing the Beatles’ there’s a million times that the choice to reject was correct.

You won’t be able to exit easily

You’re looking for returns and, ultimately, profitable exits. When investing in a VC will look at two primary ways a start-up will eventually end up; on the path to an IPO or to an acquisition by a major industry player (think of the tech sector in particular).

If the business doesn’t look likely to reach either of these milestones, perhaps think twice about jumping on board.

Honesty, honesty, honesty

All of the above red flags could turn an investor off just by themselves, but more than likely you’ll discover problems and challenges in every potential investment. It’s the way that founders approach the difficulties they face that will likely determine the success or not of their venture, and whether you’ll join them on it.

Spinning data will lead to a deterioration of trust and hiding facts will leave any relationship broken down. Open, honest founders who engage you will find themselves in much better positions in the long run, even if the deal ultimately falls through.

And the reverse is also true. Honesty and integrity from the VCs side will lead to better outcomes for everybody – even when they know about the chocolate stained sweatpants.

This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.