Equity compensation is getting popular no matter the size of the business. When you give employees stock as part of their compensation package, you of course want it to be attractive to employees and at the same time beneficial to your company.

So, stock vesting is an important component for you to consider when planning equity compensation.

What is vesting?

Vesting is the process of gaining 100% ownership of an asset. When employees are granted an asset on day one, they don’t have full control over it until the vesting period has passed.

Once it has passed (you can also say the employees have been fully vested), they own the asset and can exercise (i.e. purchase) it or sell it.

How does vesting work?

Vesting works by setting up criteria and a schedule for becoming an owner of an asset. If the criteria or schedule isn’t met, the stock is not yet vested completely.

Vesting criteria: There’re mainly 3 vesting criteria: reaching a milestone, the length of service and a combination of both. For example, if an asset has a milestone-based vesting requirement, the recipient will be able to earn it when the company reaches the milestone (e.g. IPO, performance target). If an asset has a 3-year vesting period, the recipient will need to wait 3 years before fully owning the asset.

Time-based vesting is more common than milestone-based vesting

Vesting schedule: Through a vesting schedule – Cliff vesting or Graded vesting, a recipient can gain asset ownership rights over time. Awards of stock, stock options, and RSUs are almost always subject to a vesting schedule.

Vesting criteria and schedule heavily determine the attractiveness of equity compensation and the effectiveness of staff retention. Click on the button below and speak with us if you have any questions about vesting rules

Vesting schedules: Cliff vesting, Graded vesting & Immediate vesting

In cliff vesting, employees have to complete a designated time period in the organization before they can become fully vested to receive the asset. In graded vesting, they’re gradually entitled to a bigger percentage. Immediate vesting is not as common as the other two because it doesn’t require a recipient to wait before getting the equity ownership.

| Full Years(s) of Services | Cliff vesting (over 3 years) | Graded/ratable vesting (over 6 years) | Immediate vesting |

|---|---|---|---|

| 1 | 0% | 0% | 100% |

| 2 | 0% | 20% | Nil |

| 3 | 100% | 40% | Nil |

| 4 | Nil | 60% | Nil |

| 5 | Nil | 80% | Nil |

| 6 | Nil | 100% | Nil |

Cliff vesting example: Imagine you offer your employees a stock option of 300 shares, with a 3-year cliff vesting schedule. This means they cannot exercise (i.e. purchase) them until 3 years later. After 3 years, they can exercise them at the initially agreed price (i.e. exercise price) and sell the vested shares.

Graded vesting example: In graduated vesting (also known as ratable or graded), part of the award vests –become available – in intervals.

You offer your employees a stock option of 300 shares again, with a graduated vesting period of 6 years. After the first year, they would receive 60 shares (20% of the total shares) that fully belong to them and they can exercise and sell this portion. The next year, 60 shares, and 60 shares the next year and so on.

Immediate vesting example: With an immediate vesting schedule, the employees receive 100% ownership of their shares at a share grant. It means they can exercise or sell the shares right away.

What happens to vested stock when an employee quits?

When they leave the company before the options vest, their options will be forfeited. Sticking with the same example, you offer your employees a stock option of 300 shares, with a 3-year cliff vesting schedule. If they leave before they hit the 3-year mark, they won’t get any options.

To many employees, it’s important to time their departure date to maximize the amount of vested equity if they think the company stock is valuable. So, to you as an employer, it’s important to set your vesting schedule right. Read on.

Why is it important to get your equity vesting schedule right?

As just discussed, employees usually factor equity vesting into their departure decision-making. If you get it right, you can motivate good employees to stick around longer.

What about those who don’t perform well? This is the beauty of a vesting schedule. If you set it right, you can protect your company in case your new hires don’t perform well. (Skip to idea 4 for more details)

Well.. how to get it right? Let’s see some examples to help you grasp the balance.

Idea 1: 4-year cliff vesting period – It might sound attractive for the business as it can keep employees long. But realistically, a bonus in over 4 years – no matter how big a bonus – is not likely to influence behavior. Young employees, these days, switch jobs every 2.4 years.

Idea 2: An immediate vesting for certain employees – Although this approach is not common as it has no motivation for employees to stay, you can use it to reward some key employees, e.g. those who have been working for the company for a long time.

Since the vesting schedule doesn’t necessarily need to be the same for all employees, you can customize the equity compensation plan for them.

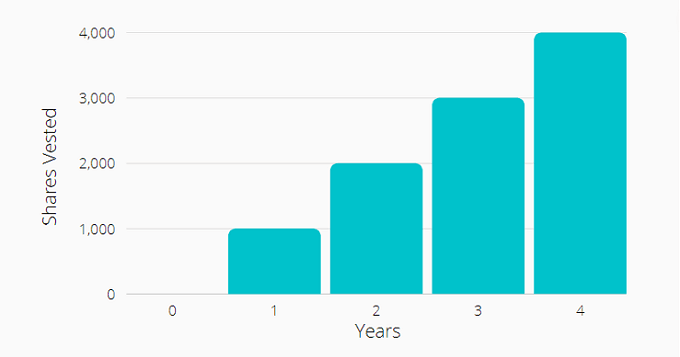

Idea 3: 1-year cliff vesting over 4 years – This idea is similar to the first one but it enables employees to vest a portion of equity (e.g. 1000 out of 4000 shares) after the first year. So they can exercise the shares and/or sell them for profit. After that, vesting occurs monthly. This is a common vesting schedule among private companies.

Of course, some employees may think “Why to put all your eggs in one basket“. So, they only stay for one year and then quit soon after hitting their cliff date for another company and doing the same thing. It inspires some companies to use another strategy – Idea 4

Idea 4: Unequal vesting schedule over 4 years – A tech company offers its employees restricted stock units with a vesting period of 4 years. During the first year, only 5% of the stock vest. After year 2, 15% percent of the stock vest. You can see the vested amount from years one and two is rather small. Years three and four, however, see a big jump where 40 percent of the RSUs vest each year.

| Year 1 | Year 2 | Year 3 | Year 4 | Total | |

|---|---|---|---|---|---|

| RSU Vesting | 5% | 15% | 40% | 40% | 100% |

If employees decided to leave after year 1, they’ll leave 95% of their stock behind. If they think the company stock is valuable in the long run, this is a great way to incentivize them to stick around longer to vest a larger portion of their equity.

This approach is also good for employers because it allows you enough time to evaluate staff performance and let poorly-performing employees go before they get the bulk of their equity payouts. Imagine if they hold a large number of company shares when leaving the company and worse still you are not able to buy them back.

Idea 5: No such thing as the ‘BEST’ vesting rule but be flexible – If you find a perfect candidate, listen to what he/she wants and try to be flexible. Some companies are willing to offer a 6-month cliff to those they really want to recruit.

Although there’s no perfect vesting schedule for an equity compensation plan, being flexible can be a win-win strategy – Employees find the plan attractive and are willing to join the team, and also feel the management is understanding in dealing with staff. You, as an employer, recruit the right person to grow the company.

How can we help?

At Global Shares, we’ve helped companies of all sizes and locations to launch their own equity compensation plans. Here, we want to give you some key factors to consider when establishing the vesting rules:

- Business goals & scale of operations (Time-based vesting builds the loyalty of the employees while milestone-based vesting focuses on performance.)

- New hire’s caliber (Be flexible to high-caliber candidates when it comes to equity compensation, as discussed in idea 5)

- Employee’s contribution to the business (Immediate vesting schedule can be considered to reward the key employees)

- Employee’s position in the organization (same as above)

- Concerns of Board (Vesting details need to be approved by the board of directors)

Once you get your plan details sorted, the next important step is equity management.

Our purpose-built platform helps to streamline the entire equity administration process, including managing different types of vesting schedules. Through the Global Shares platform, you can easily set up, track and automate all of your employee vesting schedules from one secure place, meaning less time is spent on administration and managing messy spreadsheets.

From startups to public companies, we can help you take your employee stock plan to the next level.

If you’re looking to learn more about equity compensation, check out our Equity Explained series. Whether you’re completely new to equity compensation or looking to improve your knowledge, we have a curated library of resources to help you learn all about the world of employee equity compensation.

If want to make sure your equity is in good hands, contact us for a free demo today.

FAQ about stock vesting

What does vesting mean?

Vesting is a process of gaining full ownership of an asset, meaning an employee doesn’t have full control over it until the vesting period has passed. Once it has passed, the asset belongs to the employee and can be exercised and/or sold.

How does vesting work?

Vesting works by setting up criteria and a schedule for becoming an owner of an asset. If the criteria or schedule isn’t met, the stock is not yet vested completely and you can’t exercise it or sell it.

What is a vesting schedule?

Through a vesting schedule, a recipient can gain asset ownership rights over time. There’re 3 approaches to vesting schedule – cliff vesting, graded vesting, and immediate vesting. Awards of stock, stock options, and RSUs are almost always subject to a vesting schedule.

What is cliff vesting?

In cliff vesting, employees have to complete a designated time period in the organization before they can become fully vested to receive the asset. If an employee quits before the cliff date, he/she won’t receive any equity.

What happens to vested stock when you quit?

When you leave the company, you can typically keep the vested equity while the unvested equity will be forfeited (and will usually return to the company stock pool). Stock options typically expire within 90 days of leaving the company, so you could lose the vested options if you don’t exercise them within 90 days.

Please Note: This publication contains general information only and Global Shares is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. The Global Shares Academy is not a substitute for professional advice and should not be used as such. Global Shares does not assume any liability for reliance on the information provided herein.