Once upon a time, stock options were the only show in town when it came to incentivizing employees, but in recent years the restricted stock has emerged as an increasingly popular form of equity compensation. This trend has become noticeable in both established companies and startups, with employers and founders taking note of evidence on the positive link between employees holding an equity stake in the business and improved workplace performance, and drawing up or adapting their compensation strategies accordingly.

But it’s not merely a matter of considering this evidence and then saying, “Ok, we’ll go with restricted stock.” If it were, this article would be a lot shorter than it is! No, for a company looking to either settle on or update its equity compensation strategy, deciding to go down the restricted stock route settles one set of questions, but it opens the book on another. And one of the new questions that will need to be answered revolves around whether to offer Restricted Stock Awards (RSAs) or Restricted Stock Units (RSUs) as your alternatives to stock options.

There are similarities between the two, but they also differ in some respects, so it would be a mistake to view them as interchangeable. If you are an employer looking at the possibilities, it is vital that you be clear on the differences between the two before deciding which is the best fit for your own circumstances and those of your employees.

What are RSAs?

RSAs are actual shares issued to you, but you cannot sell them until they vest – with vesting usually linked to a time-based clause and/or a liquidation event, such as an IPO or sale of the company. The vesting schedule effectively ties the hands of the recipient, in that, yes, they have been awarded the shares, but they must hold them at least until the time-based vesting condition has been satisfied.

Also, depending upon the nature of the offer, even though the employee “owns” the relevant stock from the grant date, they may still have to purchase it to complete the deal. More specifically, there are three potential scenarios on this point – the employee is given the right to purchase shares either at fair market value (FMV), with a discount, or for no cost.

Typically, with a startup, early employees will receive RSAs prior to the first round of equity funding, when the FMV of common stock is very low. If employees are offered RSAs linked to the FMV of common shares on the grant date, one of the attractions for the employee is that if the business succeeds, that value will increase over time, meaning that their shares will be worth more than they paid for them – possibly substantially more – when they vest. All in all, this can prove highly effective in incentivizing startup employees.

What are RSUs?

Whereas with an RSA, the employee can receive shares at the outset, an RSU constitutes a promise to assign shares to an individual at some point in the future – the vesting date – as long as certain conditions are met, usually relating to remaining with the company and/or achieving specified performance goals.

Another key difference worth pointing out is that while a recipient can end up paying for RSAs, this will never be the case with RSUs (aside from tax obligations, more on which later). If the employee meets the conditions attached to the RSUs at the outset, then the company will complete the process of allocating those shares to them – essentially following through on the initial promise.

Whereas RSAs can be a logical choice for startups, RSUs make more sense for established companies. One of the appeals of an RSA for an employee is the possibility of benefiting from a substantial increase in FMV over time. This is easier to imagine happening in the context of a startup. With an established, successful company, the share price might be riding high, and there may be limited scope for further upward movement (and the ever-present risk of a downward spike, depending upon the business circumstances), so in that instance, there is little incentive for employees to accept RSAs.

Vesting and restricted stock

Vesting refers to the process of earning shares over time. As indicated above, RSA vesting and RSU vesting respectively can play out quite differently.

RSAs and Vesting

Remember, you are the legal owner of RSA shares once they have been granted to you, so vesting will only come into play here when individuals leave the company – whether by their own choice or if let go. Companies will look to protect themselves by building vesting schedules into any RSA grants. Under these terms, an employer may give themselves the right to repurchase the shares of an employee who leaves the company. This clause is put in place largely to prevent a scenario whereby an individual might join a company, receive an RSA award, and then immediately leave and go elsewhere.

RSUs and Vesting

RSUs are noticeably different on this point. With this incentive, you are initially given a promise of shares at a point in the future, as opposed to receiving them upfront. So, here, the shares are not formally issued to the recipient until the various vesting conditions have been met. As mentioned earlier, typical conditions revolve around time-based vesting, performance goals, and even a liquidation condition, with the latter meaning that shares will only vest after an IPO or if the business is bought out by another company. In the event of there being multiple vesting conditions, all conditions must be fulfilled before the employee will receive the shares.

Termination and restricted stock

The key point on how termination differs between RSAs and RSUs relates to what happens to unvested shares.

RSAs and Termination

If you hold RSAs, the vested shares are 100% yours at that point, but the company will have the right to repurchase any unvested shares, and usually at whatever price the recipient paid for them. The company may or may not choose to exercise the repurchase option, but the important point to recognize here is that it will have the right to do so.

RSUs and Termination

Terminated employees with RSUs will also get to hold on to vested shares, but the situation with unvested shares can be a little more complicated. As it is not unusual to have multiple vesting conditions attached, it may be that a time-based condition has been met, but not, for example, a requirement for the company to IPO or be sold. This can be a grey area, as some companies may let the terminated employee hold onto shares that are time-vested, even if other conditions have not been met, but other companies may choose not to do so. One point on which there is no ambiguity is that shares that are not time-vested at the point of termination will be forfeited.

Tax and restricted stock

Two types of taxation are relevant here – ordinary income tax and capital gains tax (CGT).

Just as there are differences between RSAs and RSUs on vesting conditions and the implications of termination, so too do the respective taxation scenarios play out in distinct ways.

How are RSAs taxed?

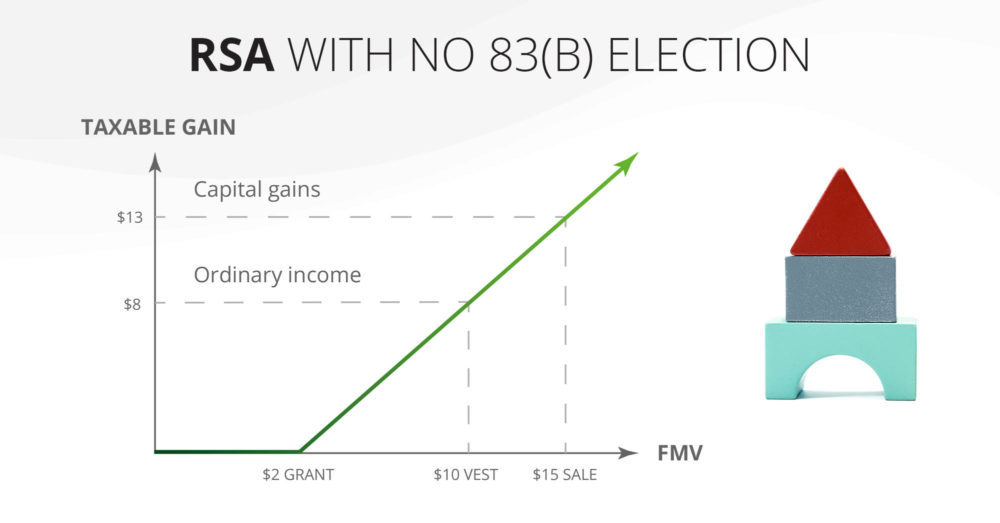

For RSAs, income tax becomes due at the point of vesting, when whatever restrictions put in place have expired. At that point, the tax liability will be assessed based on the difference between the FMV at the time of vesting and what price per share was paid (if any) at the time of the grant.

So, if an employee pays $2 per share at the time of the grant, and the FMV of that stock is $10 at the time of vesting, the taxable gain is $8 ($10-$2).

If that same employee goes on to sell those shares for a profit, then that profit (relative to FMV at vesting) will be liable for capital gains tax.

So, extending our hypothetical example, if this employee goes on to sell their shares at $15, the capital gains tax will be applied to the $5 profit per share in the transaction ($15-$10).

It shouldn’t be too difficult to identify the main potential pitfall here. Income tax becomes due at vesting, but the value of those shares may plummet after that and even become effectively worthless. You will still have had to pay the tax bill that became due at vesting, but – worst case scenario – you might find yourself bearing massive losses off the back of that. Once the taxes due on RSAs are paid, no refunds will be forthcoming, irrespective of what subsequently happen to the share price.

The good news is that there is a way around this issue – the 83(b) election.

RSAs and the Section 83b election

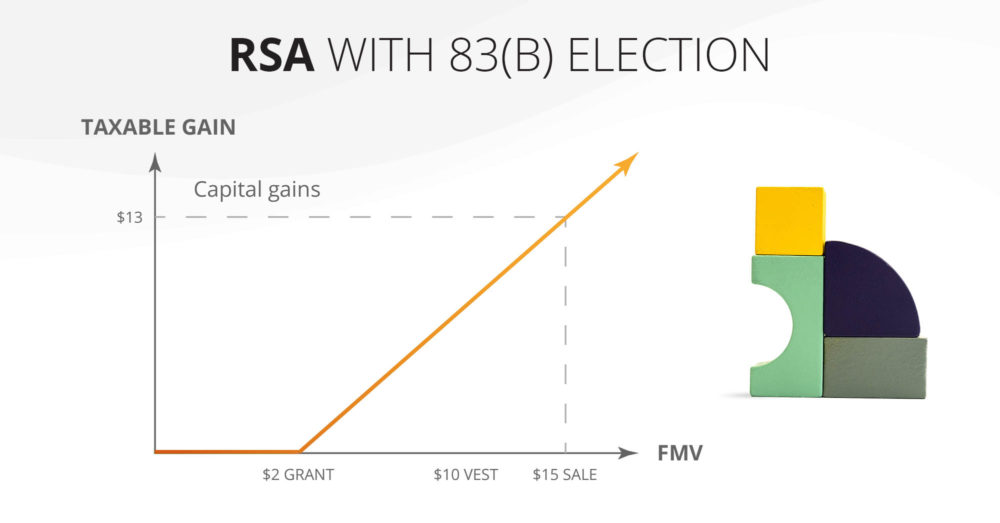

Under this provision, you can choose to pay all your ordinary income tax upfront. That might not seem like an attractive course of action at first glance, but in real terms, it can make a big difference. The key to why this works is that the taxable gain will usually be zero when you make an 83(b) election. Whatever taxable gain there is will be the difference between what the employee pays for the shares at the time of the grant and what the FMV of the shares is at that time. So, if the employee pays $2 per share and the FMV is $2, then there is no taxable gain.

From there, even if the FMV is $10 (as in our example here) at the time of vesting, no additional income tax liability falls due, because under 83(b) it has all been paid up front… even if that meant paying nothing.

However, there are implications for CGT. Sticking with the numbers we have been using, if the employee then goes on to sell the shares at $15, the CGT liability will be assessed on the difference between the FMV at grant and the sale price (as opposed to FMV at vesting). So, here, that would mean CGT assessed at $13 per share ($15-$2).

This still constitutes a big win, though, as the CGT rate will be much lower than the level set for ordinary income tax, meaning the ultimate bill will be far less than if you proceed without making an 83(b) election. And you also pre-empt the possibility of paying taxes on illiquid shares that cannot be sold.

How are RSUs taxed?

The income tax situation for RSUs is similar to that for RSAs, without the 83(b) election.

However, there is one key difference. Remember, RSAs grant shares to the recipient at the outset, whereas RSUs are a promise that the company will award shares to the employee down the line if the vesting conditions are met. The practical effect of that distinction is that it can leave the RSU holder liable for a bigger income tax bill at vesting.

So, in this scenario, an employee faces no tax bill when the RSU is granted, but will be liable for income tax on the full FMV at the point of vesting. Therefore, if the FMV is $10 at vesting, then the tax liability is calculated based on that figure.

The key difference in the two scenarios presented here being that – even aside from the 83(b) election – the recipient of an RSA will have whatever price they paid at grant time deducted from their tax liability at vesting, whereas no such provision can be put in place for RSU holders, as they don’t own the shares until the vesting moment.

CGT is handled identically, in that the liability is calculated based on whatever gain is secured on the share sale compared to the FMV at vesting.

As mentioned previously, it is common for there to be multiple conditions attached to the vesting of RSUs. A requirement for a liquidation event of some sort can be one such condition. From the taxation perspective, this creates a specific liability. So, if an employee decides to sell when their RSUs vest in this scenario – with time and liquidation conditions met – they will pay income tax on the full value of the shares at that point, rather than income tax at vesting and then CGT on any profit. Going with the numbers we have used in our examples up to now, that means if the FMV at vesting is $10 and the employee then sells at $15, the income tax liability will be assessed on the $15 value and CGT is deemed not to apply.

Difference between RSA and RSUs: Wrap-up

Some of the key points on which RSAs and RSUs differ:

- RSAs are purchased on the grant date, where RSUs are not purchased.

- RSAs will usually have time-based vesting conditions, whereas multiple conditions tend to apply to RSUs, and the recipient usually won’t own the shares until all conditions have been met.

- Upon termination, the company will have the right to repurchase any unvested RSAs, whereas any RSUs that have not satisfied the time-based vesting condition will be forfeited. If the time-based condition has been met, but other conditions are still active, then what happens to those shares will be at the discretion of the company.

- RSAs are eligible for 83(b) elections, which can see a tax bill greatly reduced, whereas RSUs are not eligible and will be taxed when they vest.

Beyond that, these points are also worth keeping in mind:

- RSAs are more popular with early-stage companies when the FMV of common stock is low and it is difficult to compete with the more established competition on salaries.

- RSUs can be a better fit for more established companies. When the company has a track record of success, that means a higher FMV, which will in turn demand a higher strike price for RSAs, which, in turn, will reduce their attractiveness. In that scenario, RSUs make more sense.

Which type of restricted stock is right for you?

As you may have guessed by now, restricted stock can be a confusing area. There is a lot to get your head around, and it is easy to lose your way somewhere along that path. That’s where Global Shares can come in, with our expertise in all equity compensation matters waiting to be put to work for your benefit. Contact us today to find out more about how we can help you to set up your plan.

Want to learn more about equity compensation?

If you’re looking to learn more about the different types of stock and how they work, check out our Equity Explained series. Whether you’re completely new to equity compensation or looking to improve your knowledge, we have a curated library of resources to help you learn all about the world of employee ownership.

Please Note: This publication contains general information only and Global Shares is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. The Global Shares Academy is not a substitute for professional advice and should not be used as such. Global Shares does not assume any liability for reliance on the information provided herein.