Name: LPKF Laser & Electronics AG

Headquarters: Garbsen, Germany

Industry: Laser & Electronics

How LPKF successfully introduced their first employee share plan

LPKF in Numbers:

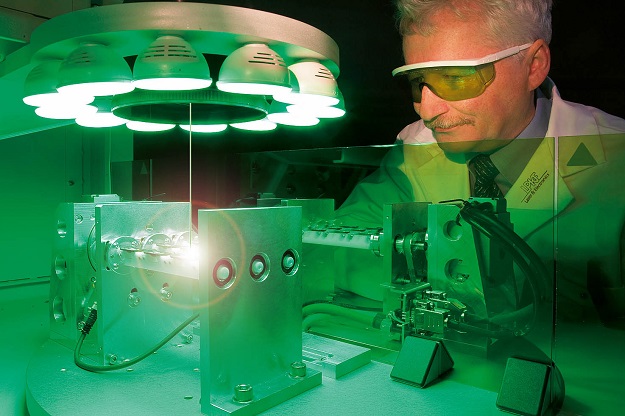

LPKF Laser and Electronics is a German-based leading provider of laser manufacturing solutions, with 40 years of experience. Their employees are laser technology experts, who ‘know how to integrate lasers as a tool into powerful machines.’ Their employees have always been a driving force behind the company and LPKF decided they wanted to make some changes to reflect that.

In 2019, LPKF started thinking about how to make that change. They wanted to give their employees the opportunity to own part of the company. And with a shortage in the German labour market, they were always fighting to get the best employees. We spoke to Annica Lau, from LPKF HR, and the eventual Project Manager of the employee share plan. The goal, as Annica put it, was: ‘Employees don’t only sign a contract – the company’s success is their success.’

The Challenges

Goetz M. Bendele, CEO, and Christian Witt, CFO of LPKF Laser & Electronics

Goetz M. Bendele, CEO, and Christian Witt, CFO of LPKF Laser & Electronics

Eventually, LPKF decided to launch an employee share plan. Most companies would have started with this, but there was a very good reason that LPKF didn’t.

Annica told us that employee share plans are ‘not common or popular in Germany, as they always have high administration costs.’

LPKF was having a hard time finding a provider, as the local banks told them they could only set one up in Germany, not worldwide. And other companies told them they were too small, even for a German-participant-only plan – ‘knock on our door when you have a thousand eligible employees.’

We’ll let Annica explain what happened next: ‘Then we met Jörg Ziegler from Global Shares. From the beginning, he was very supportive – he always knew what was going on, what we could do and could not do. He didn’t just give guidance, he gave business-proof guidance, the whole package.’

“Everybody was closing their doors, and Global Shares opened the door. They made it possible.”

What was needed?

LPKF, founded in 1976, is a leading provider of laser manufacturing solutions

LPKF, founded in 1976, is a leading provider of laser manufacturing solutions

LPKF is a small to medium-sized company. As Annica said, their share plan needs to reflect that: ‘We needed a simple solution, an affordable and straightforward ESPP. We didn’t need fancy – just one thing that works and is easily accessible.’

LPKF believed in the power of employee ownership, even in a simple plan: ‘We’re a very innovative, growing company. That’s something we build on. With an employee share plan, you reward your employees for motivation, innovation and productivity – they see that if you work hard, it will come back to you.’

Early on in the process, the Global Shares Global Compliance team, led by Steve Kavanagh, was brought in to bring further knowledge and expertise in rolling out the plan across jurisdictions.

This allowed Annica, and the LPKF team, a depth of experience and understanding of operating share plans across different jurisdictions, and helped ensure many common pitfalls and delays in rolling out the plan were avoided.

Five weeks later, the share plan was launched to the entire company, with a 47.7% enrolment rate.

What did success look like?

Annica was quite clear: this happened because of Jörg, Steve and the rest of the Global Shares team. ‘If there were any questions, Global Shares had a proper project plan – they tell you exactly what to do. You can’t miss anything because they are there to help you and guide you.’

The team’s dedication and hustle were especially crucial against such a short deadline. ‘If we asked a question, I would have expected a response in two days. Instead, we would get a response an hour later, with all the changes made. I was on my own, and I even went on holiday – but we were in safe hands.’

Global Shares was a natural fit. Our easy-to-use platform, and the oversight of industry experts like Jörg and Steve, ensured the share plan was simple for participants.

‘Global Shares adjusts their system to what the customer needs.’

And with our support team, the share plan was simple for Annica too.

What We Learned

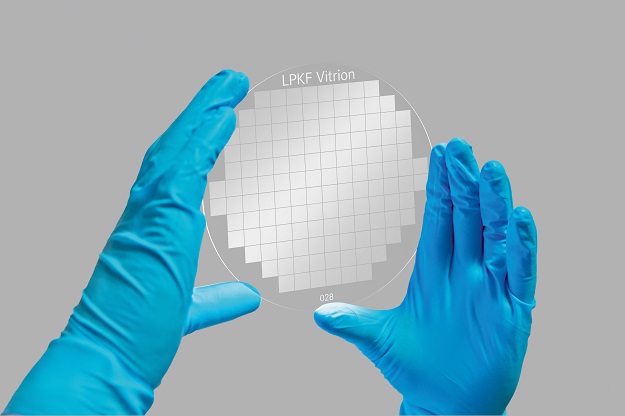

Global Shares worked in partnership with LPKF to design the ideal employee share plan for their in-house talent

Global Shares worked in partnership with LPKF to design the ideal employee share plan for their in-house talent

Equity compensation was not Annica’s daily business; she wasn’t fluent in any of it, but was the only person in charge of launching the share plan. That’s where Global Shares stepped in.

‘Global Shares is growing a lot, but I still got the feeling that everything was going smoothly – everyone was on the same page, everyone that I talked to was very knowledgeable in their branch.’

There’s a German saying – everything out of one hand. That’s what Global Shares brought to LPKF, the one-stop-shop approach. ‘Advice on Global Compliance, legal, marketing… everything you need for the project, including the day-to-day administration of the plan and the initial implementation was provided.’

Not to mention, Global Shares took charge of problems. If there were ever any questions, ‘the service team talked to the Global Compliance team of Steve Kavanagh, all within Global Shares – I’m not a part of that. They just come to me with a solution and tell me what to do.’

It was part of the overall ‘team spirit’ – Global Shares worked together, and LPKF reaped the benefits: ‘They are your team for that time, they’re rooting for you. They really want your project to be successful, and it’s a really personal service.’ Most importantly, as a Project Manager on her own: ‘I was never alone.’

And that’s what Global Shares is all about. Our equity experts, by your side and on your team – making employee ownership simple.

LPKF Story | By the Numbers

| Plan Details | |

| Programme type: | Discounted Share Purchase Plan |

| Discount: | 50% |

| Programme Details: | One-off offering per Year. Employees can invest from their net salary up to a maximum of €360.00 in tranches of €60.00 per year (personal investment) and offer |

| Use of tax exemptions: | Yes / €360.00 in Germany |

| Blocking Period: | 2 Years |

| Origin of Shares: | Share buyback via Stock Exchange |

| Offering: | Revolving once a year * |

| Number of eligible employees: | 850 |

| Implementation period until go-live: | 5 weeks |

| Participation Rate: | 48.7% |

| Type of Custody: | Collective or omnibus deposit |

| Country Coverage: | Germany, Slovenia, UK, USA, Korea, Japan and China |

| Particularities: | Dividend payments from participants are automatically reinvested in shares of the company for the participants |

| Service Providers | |

| Programme design: | In-house |

| Administration: | Global Shares |

| Tax, Legal & Regulatory: | Global Shares |

| Communication: | In-house |

Please Note: This publication contains general information only and Global Shares is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. The Global Shares Academy is not a substitute for professional advice and should not be used as such. Global Shares does not assume any liability for reliance on the information provided herein.