An employee stock purchase plan (ESPP) allows employees to purchase their company’s stock often at a discount. 50% of S&P 500 companies have an ESPP and IT is the sector with the highest ESPP prevalence (82%).

We take a look at what an ESPP is, the different types available, how an ESPP works, tax treatments and the pros and cons.

What is an ESPP?

An employee stock purchase plan (ESPP) is a broad-based stock plan that allows employees at any level of your company who the plan is made open to, to purchase company stock at a discount – often 5% to 15% off the fair market value (FMV).

They make contributions via payroll deductions. The accumulated contributions are then used to buy company stock at the agreed purchase date.

Qualified ESPP & non-qualified ESPP

There are two types of ESPPs – Qualified & Non-Qualified ESPPs.

A qualified plan is treated more favorably on taxation, but there is more flexibility in how a non-qualified plan can be designed and run.

| Qualified ESPP | Non-Qualified ESPP |

|---|---|

| Designed and operates according to Internal Revenue Section (IRS) 423 regulations | Does not need to meet IRS criteria |

| Discount ranges from 0% to 15% | Discount can go above 15% |

| Shareholder approval required | Not necessary |

| Treated more favorably on taxation | Treated less favorably on taxation |

| More restrictions to follow in plan design e.g. offering period, discount range and employee contribution levels | More flexible |

How does an ESPP work?

Like other equity plan types there are a number of steps involved in the set-up:

- Enroll in the plan: Once your employees enroll, they become eligible to participate in the upcoming offering period. They’ll need to choose how much they want to come out of their paycheck to buy company stock.

- Set aside money each month: Within an offering period, the employee contributions from each paycheck (post-tax) are set aside to purchase company stock at the purchase date.

- Stock is purchased: Typically at the end of the purchase period (i.e. purchase date), the employee’s accumulated contributions are used to purchase the stock at an agreed discount (if any).

- Sell the stock: Your employees can sell their ESPP stock right after they purchase it or hold onto it to sell at a future date in the hopes it will increase in value.

Terms associated with ESPPs:

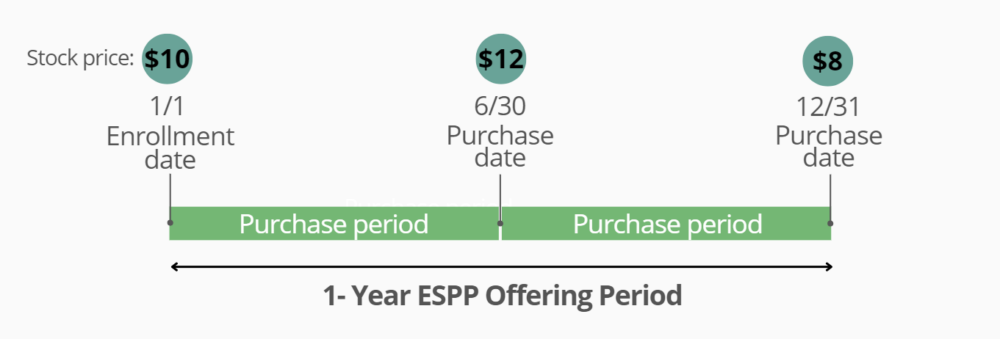

- Offering period: The period of time during which your employees can purchase company stock at an agreed discount (if any). In the example below, it’s a 12-month offering period.

- Enrollment date: The date that the employee enrolls in the plan, e.g. Jan 1 in this example.

- Purchase period: Within an offering period, there can be a series of purchase periods in which employees set aside money to purchase the stock. In this example, there are 2 purchase periods.

- Purchase date: The date on which shares are purchased, i.e. Jun 30 and Dec 31 in this case.

- Purchase price: The price at which shares are purchased by employees. This occurs on the purchase date.

ESPP lookback allows your employees to buy shares at a lower price point

An ESPP lookback feature allows the ESPP discount to be applied to the lower of two prices: either the stock price on the enrollment date (Jan 1) or the price on the purchase date (Jun 30).

An ESPP example with/without a lookback

Price on Enrollment Date: $10

Price on Purchase Date: $12

ESPP Discount: 15%

| With Lookback | Without Lookback |

|---|---|

| Purchase Price: $10 x (1-15%) = $8.5 / share | Purchase Price: $12 x (1-15%) = $10.2 / share |

Explanation:

With a lookback, your employees will be able to purchase the stock at a discount at a potentially lower price, i.e. in this instance at $10 instead of $12. Offering a lookback in addition to an ESPP discount is likely to boost your enrollment rates. Plans offering a 15% discount with a lookback have a participation rate of 44%, well above the rates for plans offering a lower discount or no lookback.

What employees can be eligible for ESPP?

An ESPP is what’s known as an all-employee program, meaning it can be made open to staff at all levels of your company. However employers can decide to exclude certain employee groups, e.g. those who have been employed for less than two years and those whose employment is twenty hours or less each week.

Additionally, ESPPs do not allow employees owning more than 5% of company stock to participate.

How are ESPP stocks taxed?

ESPP taxation depends on whether it’s non-qualified or qualified — and when your employee sells.

Non-qualified ESPP

Non-qualified ESPPs have simpler tax implications. Income tax, i.e. FMV on the purchase date minus the purchase price, is chargeable at the time of purchase. Tax on capital gain/loss, i.e. sale price minus FMV on the purchase date, is chargeable at the time of sale.

Qualified ESPP

There are two classifications of sales for qualified ESPPs: Qualifying Disposition (QD) – holding shares over 1 year after the purchase date and over 2 years after the offering date and Disqualifying Disposition (DD) – holding shares less than 1 year after the purchase date or less than 2 years after the offering date.

No tax is chargeable at purchase in both QD and DD cases.

At the sale, ordinary income and capital gains are taxed. If a QD occurs, gains are considered long-term where the tax rate is typically lower than ordinary income. If a DD occurs, gains are considered short-term and are taxed higher.

What is the best time to sell ESPP stock?

The timing of sales will depend on each individual employee’s personal and financial goals, e.g. do they need cash urgently? Do they want to pay off a debt soon? Are they confident in your company stock and how they hope it will perform in future?

Is an ESPP worth it?

For employees

An ESPP can help increase savings and offers flexibility to enable withdrawals. If the employee holds onto the shares, they can receive the potential tax benefits.

However, there is a limit on ESPP maximum contribution. Under a Section 423 plan, the IRS limits purchases to $25,000 worth of stock value (based on the FMV on the offering date) for each calendar year. Learn more about ESPP’s pros and cons here.

For employers

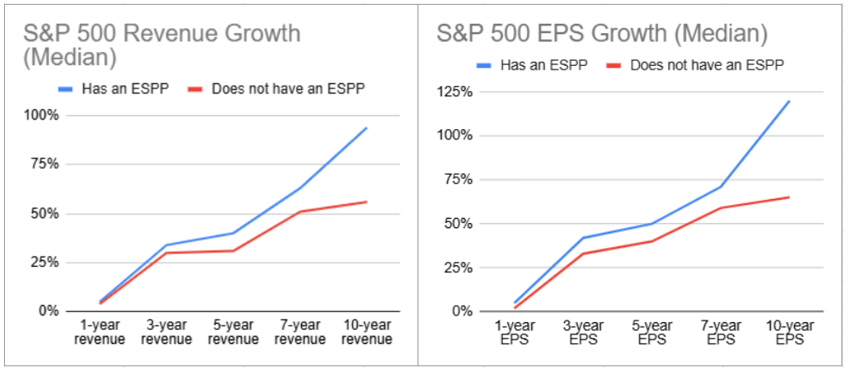

An ESPP can help attract, motivate and retain talent and work to create an ownership culture in your company. A recent ESPP survey even found that across measures like Total Shareholder Return (TSR), Earnings Before Interest, Tax, Depreciation, Amortization (EBITDA), Earnings Per Share (EPS), and revenue growth, there’s an obvious trend of outperformance for S&P 500 companies with an ESPP.

Despite these benefits, managing a plan can increase HR, accounting and administrative workload. You also need a communications plan to educate your employees about ESPP and keep them engaged.

What next?

At J.P. Morgan Workplace Solutions can help you navigate through the difficulties of managing ESPPs from employee enrollment to contribution and purchase management, participant communications and above board. Thanks to our advanced software and a team of 300 equity professionals, we’re trusted by hundreds of companies, from start-ups to publicly traded companies, across a multitude of industries in more than 100 countries.

Contact us to learn more about how we can help design, launch and manage your ESPP.

By visiting a third-party site, you may be entering an unsecured website that may have a different privacy policy and security practices from J.P. Morgan standards. J.P. Morgan is not responsible for, and does not control, endorse or guarantee, any aspect of any linked third-party site. J.P. Morgan accepts no direct or consequential losses arising from the use of such sites.

This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.