Equity compensation-related financial reporting is demanding, but vital to get right for any

company. Find out how one international business goes about meeting their obligations across

several jurisdictions.

Financial reporting of equity compensation can be a time-consuming and complex process for any

business, and perhaps even more so if you’re a large company operating in multiple countries and

across different continents.

The need to abide by the different rules and regulations on reporting seen in various jurisdictions,

and to do so in a timely manner is of paramount importance and can bring with it a considerable

administrative challenge, depending upon the size of the enterprise involved.

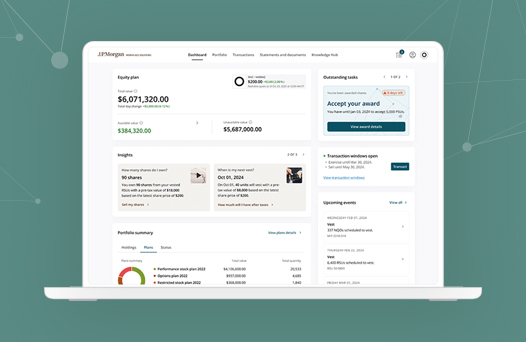

That was the main topic on the most recent episode of our Prosperity at Work podcast, which saw

J.P. Morgan Workplace Solutions’ own Chris Dohrmann, Executive Director, Strategic Partnerships,

and Lauren Jenkins, VP, Head of Executive Participant Servicing take a deep dive into the reality of

financial reporting for a large business operating across borders with Lily Anne Nueva España,

Director of Global Accounting with Coupang, a South Korea-based e-commerce company with an

international presence.

Founded in 2010, Coupang went public in one of 2021’s most successful IPOs, and while not

necessarily a household name in all corners of the world, the New York Stock Exchange (NYSE)-listed

company reported net revenues of $7.1 billion for 2024 Q1, has been described as ‘the Amazon of

South Korea’, is a major player in Singapore, India, China, and Hong Kong, and has also established a

foothold in parts of Europe following the recent acquisition of online fashion retailer Farfetch.

Against this backdrop, the company faces many different reporting requirements at any given time,

and must grapple with the ongoing challenge of ensuring that it meets those obligations.

“We have to file all the standalone financials for each country where we operate,” Lily Anne said,

adding that in practice they need to meet dual accounting standards – the internationally-recognized

IFRS 2 and also US GAAP, the latter obligation arising from Coupang being listed on the NYSE and the

company having a base in Seattle, Washington.

Lily Anne explained that one of the ways the company seeks to cope with the complexity of its

reporting requirements is to allocate expensing down to the corporate budget level, i.e., expenses

are kept in the local system and allocated that way.

“Each employee is assigned a cost center and an entity. We do that using our HR system, which we

interface with the Workplace Solutions software. We can allocate the data on expense for individual

employees using the cost center and entity fields on the system and then in our reporting.”

An additional complexity that the company has to cope with is that they do a roll-forward for every

reporting period.

“One of the biggest disclosures needed for the SEC filing is the roll forward of the shares. It is

presented in our statement of equity, and also in our footnotes. At the outset, you need to have

your beginning balance and be clear on whatever is outstanding, and then track what happens

during the reporting period. We use Workplace Solutions for all this work. For example, we use the

software to get the release report, the exercise report, the for future report, and the grant balance

report. Once we reconcile all these reports, we can get the disclosures that we need for our filing,”

Lily Anne said.

She also stressed the need for effective communications with stakeholders throughout the process.

“It is very important. They let us know what they need ahead of time. That’s how it works with

accounting. Everything is going to be check-listed, what you need, when you need it, the deadline.

Most of that will be in our checklist, so we know when it’s needed, but sometimes a stakeholder will

ask for something else, and that’s where the Workplace Solutions software helps a lot, because using

it we can generate reports whenever we want. That means we are always ready to respond,” she

said.

When asked what three things are essential for her to be able to do her job properly when

converting data onto the system, Lily Anne singled out accuracy, timeliness of reports and processing

data and having a partner that they can rely on to act quickly whenever there is an issue that needs

to be addressed.

To listen to the full interview, click here

All companies referenced are shown for illustrative purposes only, and are not intended as

a recommendation or endorsement by J.P. Morgan in this context.

By visiting a third-party site, you may be entering an unsecured website that may have a different

privacy policy and security practices from J.P. Morgan standards. J.P. Morgan is not responsible for,

and does not control, endorse or guarantee, any aspect of any linked third-party site. J.P. Morgan

accepts no direct or consequential losses arising from the use of such sites.

Logos are trademarks of their respective owners and are used for illustrative purposes and should

not be construed as an endorsement or sponsorship of J.P. Morgan Securities LLC.

This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.