Equity management is an ongoing and complex process, encompassing everything from award granting and tracking, to monitoring employee activities (new joiners, leavers, etc), to processing reports, managing stakeholders and staying compliant across various jurisdictions.

If you’re a pre-IPO company currently converting from private to public, you’ll no doubt be anticipating significant changes ahead for your existing equity compensation structure and preparing to put new plans in place as part of the IPO process.

Read on to learn ways you can mitigate the challenges and seek a smooth transition for your equity compensation plans.

Why should your new equity compensation plans be put in place pre-IPO?

It’s usually considered a best practice to prepare for your new equity compensation plans ahead of being formally admitted to the market.

– Ability to capitalize on the excitement at IPO: Early planning can allow you to offer equity grants at or soon after the IPO, helping to ensure the IPO excitement is felt by your employees at all levels of your business.

– Easily approve stock plan share reserve: A pre-IPO company will need to consider the size of its stock plan share reserve when heading into an IPO and should approve any increase to the share reserve. It’s normally substantially easier to obtain any necessary stockholder approval of the increase prior to the IPO as compared to after the IPO.

Pain Points & solutions for equity management in pre-IPO companies

Pain Point 1: Lack of proper structure to approve and administer equity compensation awards

Solution:

In a private company setting, the parties responsible for equity compensation approval and administration can be very unclear, sometimes resulting in inefficient compensation planning and SEC filings.

Prior to an IPO, you should carefully consider establishing public company governance structures and processes to help transform your equity compensation program.

In a public company setting, there’s oftentimes a formal compensation committee in place whose role it is to determine the company’s compensation and benefits philosophy. They will normally recommend the long-term incentive plan to the full board for approval, and discuss the Compensation Discussion and Analysis (CD&A) that is required in their annual SEC filings, etc. These equity administrative responsibilities would usually fall within the remit of human resources.

These kinds of established structures are a fundamental step in supporting the all-important compensation transition to public company status.

Pain Point 2: Rework the compensation structure for executives and non-executive employees

Solution:

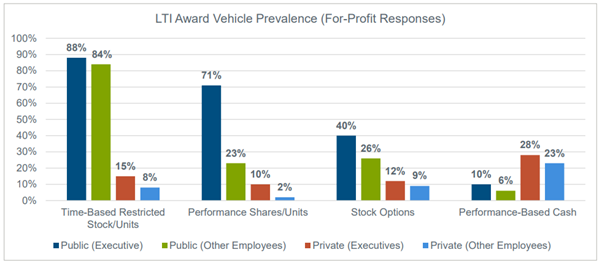

A post-IPO compensation structure can be very different to what existing beforehand, e.g. shift in approach to equity awards, higher grant frequency, wider eligibility, etc. Your compensation committee should review what equity compensation grants you currently offer, how successful they’ve been (or not been), their eligibility criteria and all of the design details.

Following that, you should start discussing some of the potential post-IPO compensation issues:

- A compensation philosophy (e.g. objectives, pay mix, and competitive position)

- Alignment of executive pay levels to business objectives and/or competitive practices

- A long-term (equity) incentive plan (LTIP)

- Severance benefits and termination treatment

This step of equity compensation planning is important and could significantly benefit your business in retaining, rewarding and attracting executive talent. There’s increased public scrutiny around executive compensation in recent years, which is near all-time highs across S&P 500 companies, and not getting this step right could risk bringing negative public or media attention.

In addition to updating your executives’ compensation, you may choose to introduce an all-employee share plan such as an employee stock purchase plan (ESPP) to allow employees to purchase stock in the company. Launching an ESPP at IPO rather than post-IPO is generally considered to be best practice.

Pain Point 3: More equity awards/plans and participating employees to manage

Solution:

Offering more equity grants and plans to wider teams will result in more complex equity and employee management. Managing large amounts of dynamic equity and employee data won’t be an easy, DIY thing. Imagine the repercussions if you forget to update any changes in employee activities or share plan tasks. This could cause inaccurate reporting and even wrong tax filings which could have implications for both the company and employees.

In the lead-up to an IPO, consider adopting equity compensation software that supports a wide range of equity awards and plan types, one which can help to support your business as you scale. Choosing a software solution can streamline the day-to-day execution of transactions, with full automation of tracking, and administration of all equity activities for you. It can also serve as a single source of truth with all information in one centralized place to avoid confusion.

Such software typically comes with a 24/7 online participant portal that engages employees to manage their own equity. Once they log onto their account, they are allowed to track the life cycle of their equity, manage/transact their assets, and access the documentation, reducing your administration burden.

Pain Point 4: Extensive reporting and disclosures

Solution:

The more employees and equity types you have, the more complex your reporting becomes. Reporting and disclosure requirements are generally stricter at a public company so it can be highly beneficial if your equity management solutions automate the reporting process, rather than you having to process it manually.

Some software programs have a reporting suite built in, enabling you to directly access standard reports like earnings per share (EPS) and fair value. You can typically get a real-time, audit-ready report with just a few clicks or schedule these to be automatically generated. This feature simplifies your reporting process and ensures accurate record-keeping.

Pain Point 5: Stock plan extension globally

Solution:

It’s a common practice for companies to grant equity to employees based internationally when looking to unite a global workforce with common goals. However, staying compliant in each jurisdiction can prove challenging as local laws and regulations often differ or can change.

You can choose to offload this task to a global stock plan provider, like J.P. Morgan Workplace, that already has extensive knowledge and experience running global stock plans. They usually have robust on-the-ground teams that stay on top of the latest local laws and regulations associated with equity compensation, working alongside you to reduce legal risk and stay compliant across the entire organization.

Pain Point 6: Employee communications

Solution:

If you aim to launch an LTIP and/or ESPP at IPO, it’s important to develop an employee communication program in the lead-up to the IPO in order to explain what equity compensation is, how the plan operates, its values and benefits, tax implications, rules and requirements, etc. However, this type of program planning can be challenging for pre-IPO companies, especially if they’re already under heavy IPO pressure and their compensation programs are getting increasingly complex.

Why not outsource to a stock plan vendor with experience in developing customized employee communications programs? They can help you segment your employees, create a communications package, demystify the equity process and translate materials into multiple languages needed.

Converting from private to public constitutes a massive change for any company. That’s why pre-IPO companies typically onboard a stock plan service provider and use its technology to help manage and migrate their equity compensation plans before they expand.

At J.P. Morgan Workplace Solutions, we provide equity management solutions with support from a robust team of equity professionals. Contact us if you want to learn more about equity management software and how it could help you operate a stock plan.

Please Note: This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.