Vesting is a waiting process of gaining ownership of an asset. A recipient doesn’t have full control over his/her asset until the vesting period has passed.

So, vesting is considered an effective retention approach to motivate employees to stick around and work harder to grow the company’s value.

In this article, you’ll learn different vesting schedule examples to help you build one that is suitable for your business and employees.

Three types of vesting schedules

A vesting schedule shows when a recipient will earn his/her asset.

It comes in three approaches – cliff vesting, graded vesting, and immediate vesting. If a vesting schedule is set up right, it’s likely to motivate your employees and make them stay longer.

The table below shows how each vesting schedule works:

| Full Year(s) of Service | Cliff vesting (over 3 years) | Graded/ ratable vesting (over 6 years) | Immediate vesting |

|---|---|---|---|

| 1 | 0% | 0% | 100% |

| 2 | 0% | 20% | Nil |

| 3 | 100% | 40% | Nil |

| 4 | Nil | 60% | Nil |

| 5 | Nil | 80% | Nil |

| 6 | Nil | 100% | Nil |

In cliff vesting, an employee has to complete a designated time period in the organization before they become vested to receive the asset.

In graded/ratable vesting, they’re gradually entitled to a bigger percentage of their asset.

Immediate vesting is not as common as the other two because it doesn’t require a recipient to wait before getting equity ownership.

Job termination almost always stops vesting except in certain situations like death, disability, or retirement, depending on your plan and grant agreement.

Vesting Schedule Examples

Example 1: 4-year cliff vesting period

It might sound attractive for a company as it can keep employees longer. But realistically, a bonus in over 4 years – no matter how big a bonus – is not likely to influence behavior. Young employees, these days, tend to switch jobs every 2.3 years.

Example 2: Immediate vesting for certain employees

Although this approach is not common as it has no motivation for employees to stick around, you can use it to reward some key employees, e.g. those who have been working for the company for a long time.

Since vesting schedules don’t necessarily need to be the same for all employees, you can customize the equity compensation plan for them.

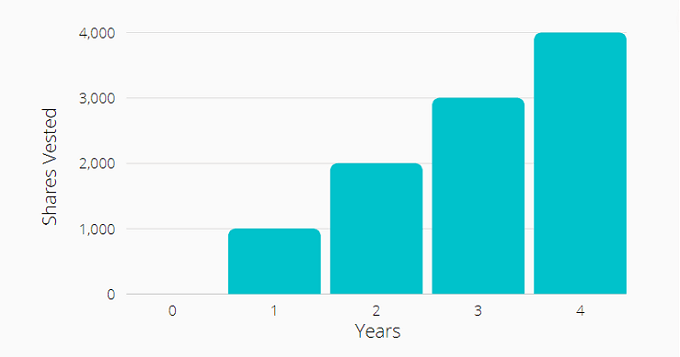

Example 3: 1-year cliff vesting over 4 years

This idea is similar to the first one but it enables employees to vest a portion of equity (e.g. 1000 out of 4000 shares) after the first year. So they can exercise these vested shares and/or sell them for profit. After that, vesting occurs monthly. This is a typical vesting schedule among startups (Source: Contracts Counsel).

[For illustrative purposes only]

Example 4: Front-loaded vesting over 4 years

A tech company offers its employees restricted stock units (RSUs) with a vesting period of 4 years. During the first year, only 5% of the stock vest. After year 2, 15% of the stock vest. Years three and four, however, see a big jump where 40% of the RSUs vest each year.

| – | Year 1 | Year 2 | Year 3 | Year 4 | Total |

|---|---|---|---|---|---|

| Vested RSU | 5% | 15% | 40% | 40% | 100% |

If employees decided to leave after year 1, they’ll leave 95% of their stock behind. If they think the company stock is valuable in the long run, this can be a helpful way to incentivize them to stick around longer to vest a larger portion of their equity.

This idea is also good for employers because it allows you to have enough time to evaluate staff performance. With this approach, you can let poorly-performing employees go before they get the bulk of their equity payouts. Imagine if they hold a large number of company shares when leaving the company and worse still you are not able to buy them back.

Example 5: There’s no such thing as perfect but be flexible

According to CNBC TV18, flexibility becomes the norm when it comes to vesting. If you find a perfect candidate, listen to what he/she wants and try to be flexible.

Although there’s no perfect vesting schedule for an equity compensation plan, being flexible can be a win-win strategy – Employees find the plan attractive and are willing to join the team, and also feel the management is understanding in dealing with staff. As an employer, you recruit the right person to grow the company.

Amazon is considering a shift to a monthly vesting schedule (from annual vesting) for employees at Level 7 or higher. Google has shifted to more front-loaded vesting for its RSUs – from vesting 25% evenly each year to vesting 33% per year for the first two years of employment. (Source: Forbes)

How we can help with vesting?

At J.P. Morgan Workplace Solutions, we’ve helped companies of all sizes and locations to launch their own equity compensation plans. Here are some considerations when establishing the vesting rules:

- Business goals & scale of operations – Time-based vesting can help build the loyalty of the employees while milestone-based vesting focuses on performance.

- Can they attract talent – Be flexible to high-caliber candidates when it comes to equity compensation. Also, make sure to keep an eye on your competition – are they moving from annual vesting to quarterly, etc.

- Can they reward key employees – Immediate vesting schedule can be considered for certain important staff members.

- Concerns of Board – Vesting details need to be approved by the board of directors. Not considering the board in the first place can result in rejection. Once you get your plan details sorted, the next important step is equity management.

Contact us if you want to learn more about how J.P. Morgan Workplace can support you in managing your equity effectively.

All companies referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by J.P. Morgan in this context.

By visiting a third-party site, you may be entering an unsecured website that may have a different privacy policy and security practices from J.P. Morgan standards. J.P. Morgan is not responsible for, and does not control, endorse or guarantee, any aspect of any linked third-party site. J.P. Morgan accepts no direct or consequential losses arising from the use of such sites.

Please Note: This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.