Stock options offer employees a chance to share the company’s success. If you’re a private company, it can be a challenge for your employees to figure out what they could do with their options. Here are six things employees at private companies need to know about their private company stock options:

1. Understand the basics of private company stock options

Employee stock options are a popular form of equity compensation offered by companies to attract, motivate and retain talent.

When a private company has a chance to go public, its pre-IPO stock options can be very valuable for employees. The potential financial benefits are more significant than cash if the stock value appreciates a lot post-IPO. Besides the benefits, here are some basics about options that employees need to know:

- Type of stock options granted: There are typically two types of stock options – Non-qualified stock options (NSOs) and Incentive stock options (ISOs). To learn about their differences, check out the NSO vs ISO guide.

- No. of option shares granted

- Vesting schedule: Employee stock options are often subject to vesting which is the process of earning the right to exercise the options. This is an important mechanism for employee retention. Read more here: How does vesting work?

- Exercise price: The price that an optionee has to pay for the stock when purchasing his/her options

- How to exercise options: Usually there are different ways available for option-holders to exercise their options, such as monetary exercise and cashless exercise.

- Expiration date

- Illiquidity: Since your company is privately-held, it’s often difficult to convert that stock or option into cash until a liquidity event occurs (such as a recapitalization, sale of the company, or going public). Make sure your employees stay well-informed about any liquidity event.

2. Know the value of stock options in private companies

Unlike a publicly-traded company that always has a readily available stock value, a private company can only estimate its stock value based on the assessment of your company’s value.

Why do employees need to know this value? Because they need to know how much their stock options are worth to help understand the company’s performance, estimate their tax bill and see if their exercise was a good decision.

3. Pay tax bills out of pocket at the exercise of private company stock options

Whether your company is public or private, optionees may owe taxes at the time of exercising their options.

In a public company, they’d be able to sell the shares right after exercising. They can then use the sale proceeds to cover the exercise costs rather than pay out of pocket. However, in a private company, they have to use their personal fund to pay the costs associated with exercising private company stock options.

With ISOs, the exercise can trigger an Alternative Minimum Tax (AMT) liability. With NSOs, income taxes are triggered in the year of exercise. The bargain element (the difference between the exercise price and the FMV at exercise) will be taxed the same as the earned income.

Despite paying taxes with personal money, there are benefits of exercising pre-IPO stock options if the company begins the process to go public. Read on.

4. Exercise pre-IPO stock options with fewer risks and more benefits

If you exercise your options while your company is private and has no plan for a liquidity event, you may take on the risk of holding on to illiquid company shares.

But, if the company begins the process to go public, exercising your pre-IPO options may be less risky. Reasons:

- Your shares will have a chance to become liquid.

- Your cost to exercise will be low. (Stock options at private companies are often issued with a low exercise price)

- Your shares will likely be worth more than your exercise price.

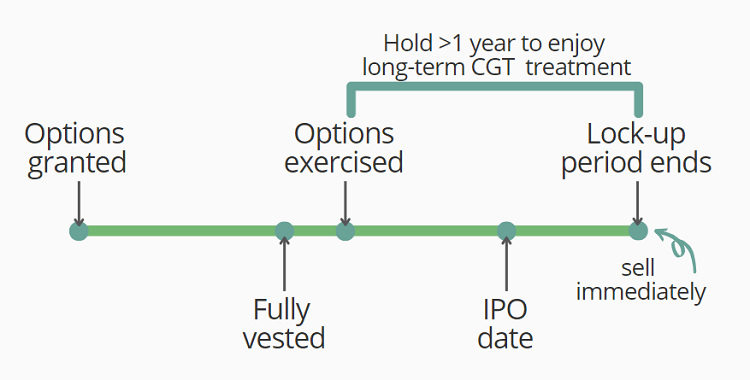

Exercise your pre-IPO options when your company begins the IPO process can also bring you tax benefits while allowing you to sell the shares as soon as possible.

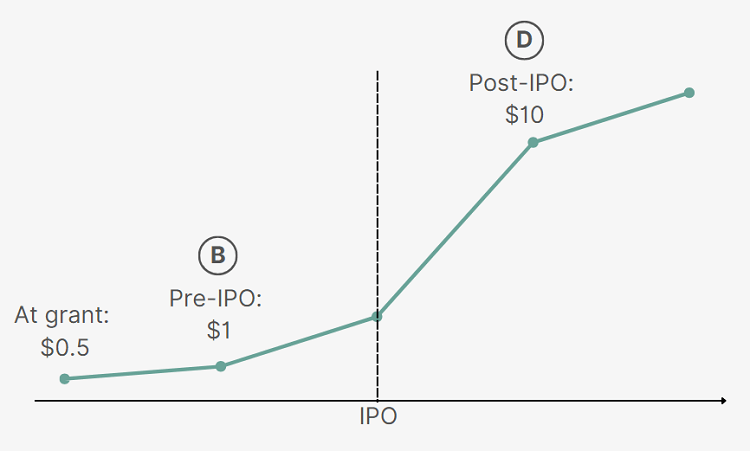

- Enjoy a smaller tax bill at exercise: Assuming you exercise 100 shares of your NSOs pre-IPO (at point B), your bargain element ($1 – $0.5) x 100 = $50 will be taxed as ordinary income. If you exercise your options post-IPO (at point D), your bargain element will be more significant ($10 – $0.5) x 100 = $950. Although no one knows the future stock price, there’s a potential price appreciation following IPO to likely cause a huge tax bill.

- Enjoy favorable long-term CGT at sale and being able to sell shares right away: At the time of sale, if your holding period for your NSOs (from the exercise date to the date that the lock-up period ends) is at least one year, you’ll be able to have preferential tax treatment (i.e. a lower long-term CGT rate) and sell your shares right after the lock-up period ends.

Important note: It’s not uncommon for startups to fail and for the options to end up worthless but stock options are still likely to build personal wealth for startup employees.

5. Allowed to sell private company shares or not

Unlike stock in public companies that is easily tradable, stock in privately held companies is typically not liquid and is difficult to sell. Companies should inform employees of any possible way to sell their private companies shares in case they need immediate cash.

Some companies may allow for the sale of private companies shares while some may not. Even if your plan is allowed to do so, it may not be as simple as trading on a stock exchange because there may be restrictions in a secondary market. So, this information should be well explained so that employees can prepare and adjust their financial plans.

6. Private company stock options vs Public company stock options

| Private Company Stock Options | Public Company Stock Options |

|---|---|

| Lack of liquidity | Easily tradable due to liquidity |

| Lower tax bill at exercise | Higher tax bill at exercise |

| Cover exercise costs with personal funds | Cover exercise costs by selling shares |

| Estimate the stock value | Know the exact stock value immediately |

| Higher potential upside | Potentially less upside |

Stock options offer employees a chance to share the company’s success. If you are looking to draft a plan of stock options or other types of equity compensation, contact Global shares today.

Our award-winning platform can provide a fully-integrated equity compensation management solution. It means from software and administration to compliance and reporting – we can help your employees take full advantage of stock ownership.

Please Note: This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.