What are stock appreciation rights (SARs)?

Stock appreciation rights (SARs) are a type of equity compensation that ties to your company’s stock price to motivate and retain employees. It provides the holder with the ability to profit from the appreciation in the value of the awards.

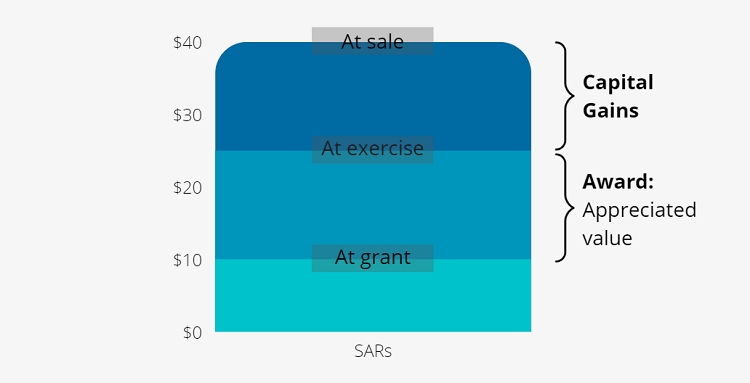

When thinking of SARs, always focus on the ‘Appreciation’ part. That’s because SARs are rewarded based on the appreciated value – the difference between the stock price at the time you were granted and the price at the time you get them.

SARs do not include rights to dividends or voting rights.

How do stock appreciation rights work?

Grant: Like stock options, SARs are granted at a set price which is used to calculate the appreciated value at the time you receive them.

Vesting: SARs often have a vesting period (i.e. vesting means ownership, a waiting period before gaining the award ownership) and expiration date. Once a SAR vests, employees can exercise (receive) it anytime before its expiration date.

Exercising/Receiving: Unlike stock options that require employees to pay an exercise price (or called purchase price), employees DO NOT need to make any upfront payment to receive the awards.

When you want to receive your SARs, you typically notify your company according to the procedures in your stock plan or grant agreement. You will get the proceeds of a stock increase either in cash or in an equivalent number of company shares (or a combination of both).

Example of Jane who is granted 100 SARs:

At the time of the grant, the stock price is $50. After vesting, the stock price is $66 and Jane wants to receive the award at this time. So, each of Jane’s SAR is worth $16 ($66 – $50), meaning she is awarded $16 x 100 = $1,600.

If the amount is paid out in a form of cash, Jane will receive $1,600 in cash. If it is paid out in shares, she will receive 24 shares ($1,600 / $66). Again, Jane can get this $1600 benefit without having to pay for the SARs.

Stock appreciation rights taxation

As an employee, you don’t have to report anything for tax purposes until you exercise/receive your awards.

Here’s each stage of the SAR life cycle:

Grant: There are no federal income tax consequences when you are granted SARs.

Vesting: Again, no tax consequences at the time of vesting.

Receiving: The appreciated value gets taxed as earned income and is subject to payroll tax. The appreciation is the difference between the market price at receiving awards and the market price at grant, multiplied by the number of SARs received. Using Jane’s example:

Taxable income: $1600 = [($66 – $50) x 100]

Sale: If you receive shares of stock after vesting and then decide to sell, you may owe capital gains tax. Sticking with the same example, if Jane decides to sell her SARs for $70, post-exercise share price appreciation will be taxable as short-term/long-term capital gain.

Capital Gains: $96 = ($70 – $66) x 24

(Note: You must hold your SARs for at least 1 year after exercise to have the sale proceeds taxed favorably as long-term capital gain)

What happens to my stock appreciation rights if I leave my employer

Generally, termination (e.g. retirement, injury and changing job) triggers the acceleration of SAR expiration, depending on your employer’s plan rules. You typically have limited time to exercise the vested awards.

Benefits of stock appreciation rights to employers

The benefits of SARs for employers can be summed up in a few words; flexibility and less dilution of shares. This is without taking into consideration the primary aims of employee equity compensation – motivating, retaining and attracting talent.

- Flexibility: You can plan SARs in varied ways to suit different individuals e.g. via vesting rules and how to pay out the SARs – cash or shares

- Less dilution of stock: SARs provide employers with a means of offering employees equity-linked compensation without the need to dilute their stock because they require the issuance of fewer company shares.

- Motivate, reward, retain and attract talent: You can determine the vesting schedule on an individual basis to achieve these purposes.

- Favorable accounting rules: Stock-settled SARs receive fixed accounting treatment instead of variable and are treated in much the same manner as conventional stock option plans.

Benefits of stock appreciation rights to employees

The biggest benefit for employees when it comes to SARs is that they don’t have to pay for the cost of the shares.

Employees will benefit from the SARs when the company’s stock price rises and they receive the sum of the increase in stocks or cash (usually the latter). However, if the stock price doesn’t rise, then the promised reward won’t materialize.

In other words, employees don’t take any real risk with SARs but are also subject to stock market fluctuations.

But, stock appreciation rights aren’t suitable for all companies

If you’re in any of the following situations, other types of equity compensation may be more appropriate for your company.

- We have a concern that employees may not be incentivized by potential future cash bonuses without ownership

- My company prefers to use a traditional equity award.

- We prefer to offer equity that allows for tax event delay until the sale of the stock

At Global Shares, we handle all the equity award administration so you’ve nothing to worry about. Get in touch to find out how we can assist with equity design and management.

Please Note: This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.