Employee Stock Purchase Plans (ESPPs) are widely regarded as one of the most simple and straightforward equity compensation strategies available to businesses today.

There are two major types of ESPP: 1) Qualified ESPP offering tax advantages and 2) Non-qualified ESPP offering flexibility. Before we highlight the distinctions between them, we need to first be clear on the core characteristics of ESPPs.

What is an ESPP?

An ESPP is an employee ownership scheme that enables employees to purchase company shares from their salary at a discount – usually up to 15%. Over time, they build up a savings pot, which is then used to buy company shares on the nominated purchase date.

An ESPP can give employees an easy and cost-effective reward for pursuing a disciplined savings plan to build financial wealth. It’s also beneficial to employers because workers who hold company shares will tend to think and act in the long-term interests of the company.

Employee Stock Purchase Plan: Qualified or Non-qualified

Now, we can have a look at the key difference between the two types.

An ESPP qualified plan is designed and operates according to Internal Revenue Section (IRS) 423 regulations, whereas a non-qualified ESPP does not meet those criteria.

This means that there is more flexibility in how a non-qualified plan can be designed, but a qualified plan is treated more favorably on taxation as there’s no taxable event when shares are purchased. Indeed, the term ‘qualified’ is used to refer to its tax-advantageous status.

| Qualified ESPP | Non-Qualified ESPP |

|---|---|

| Contribution made with after-tax dollars | Contribution made with after-tax dollars |

| Designed and operates according to Internal Revenue Section (IRS) 423 regulations | Does not meet IRS criteria |

| Discount ranges from 0% to 15%, with 15% most used | May offer a discount of more than 15% from the current FMV of the stock |

| Approved by shareholders | Not required |

| More favorably on taxation, e.g no tax events at purchase | Less favorably on taxation, e.g. ordinary income is taxable at purchase |

| Less flexible in plan design | Flexible in plan design, e.g. offering a match or subsidy |

Approximately 79% of ESPPs are qualified in the U.S. based on the NASPP Domestic Stock Plan Survey 2020 but the allure of a nonqualified plan can be strong for some companies due to:

- Free of the restraints of Section 423

- Not having to worry about the $25,000 limit

- Not having to track dispositions

Of companies that offer ESPP to non-US employees, about 50% offer a non-qualified plan in those countries. So for companies who have a large population of employees outside the US, why let tax advantages drive your design decisions as it only benefits one segment of your employees?

Whether you decide to roll out a qualified plan or a non-qualified plan, you can easily set it up in our ESPP software. Contact us to learn more about how to design or manage these two types of ESPP.

A Closer at Qualified ESPP – Qualifying & Disqualifying Dispositions

I know what you’re probably thinking, “There are different types of Qualified ESPP, too?” The answer is yes. There’re two classifications of sales for qualified ESPPs: qualifying and disqualifying dispositions.

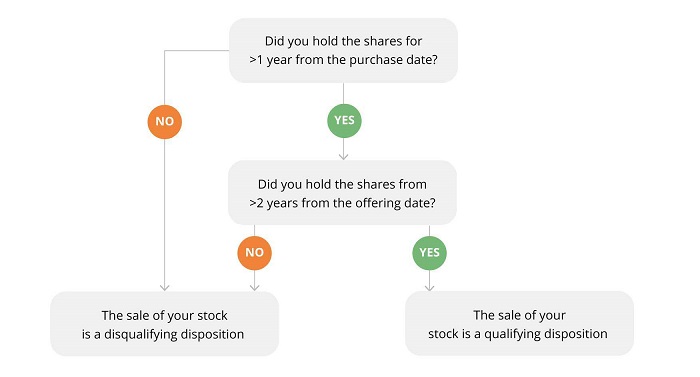

Does it matter to know the type of sale of your ESPP shares? Yes again because the employee stock purchase plan tax implications can be quite different. The main difference between qualifying and disqualifying disposition is the holding period.

Use the flow chart below to quickly help you identify if the sale of your shares is an ESPP qualifying disposition or an ESPP disqualifying disposition.

• • Difference between qualifying and disqualifying disposition • •

ESPP Qualifying Disposition (QD): Under this plan, employees purchase stock at a discount from the fair market value, yet do not owe taxes on that discount at the time of purchase.

An ESPP QD occurs when employees hold their shares for a period of at least two years from the offering date AND at least one year from the purchase date. When you sell your shares after the holding period, the discount is taxed as ordinary income, and the rest of the gains is taxed at the long-term capital gains rate which is usually lower.

ESPP Disqualifying Disposition (DD): Under this plan, you do not owe taxes at the time of purchase. Unlike the plan above, an ESPP DD occurs when employees don’t meet the holding period – EITHER hold their shares for a period of fewer than two years from the offering date OR less than one year from the purchase date.

When you sell your shares right away (i.e less than 1 year from the purchase date), any gains are considered short-term and are taxed typically higher.

• • • Situation 1: Disqualifying Disposition (DD) • • •

This example is an ESPP DD situation because you sold the shares less than 2 years after the offering date. It’s considered short-term because there was less than 1 year lapsed between the date you purchased the shares (June 30, 2020) and the date you sold them (January 20, 2021).

Initial Price in the offering period

(Start from 01/01/2020)$20

| Information | – |

|---|---|

| Price on the Purchase Date (06/30/2020) | $25 |

| Discount | 15% |

| Actual Purchase Price | $17 |

| Sales Price (01/20/2021) | $50 |

| No. of Shares | 100 |

| Sales Commission | $10 |

According to qualified ESPP tax rules, you will need to pay taxes on ordinary income and capital gains at the time of sale.

The difference between the actual purchase price ($17) and the price on the purchase date ($25) is taxable ordinary income. It is sometimes called ‘’Bargain Element’’

Total Sales Price minus Commission: ($50 x 100) – $10 = $ 4990

Cost [Total Actual Price + Amount in Part A]: $17 x 100 + $800 = $2500

• • • Situation 2: Qualifying Disposition (QD) • • •

This is an ESPP QD situation because you sold your shares at least 1 year from the purchase date AND at least 2 years from the ESPP offering date.

Initial Price in the offering period

(Start from 01/01/2017)$20

| Information | – |

|---|---|

| Price on the Purchase Date (06/30/2017) | $25 |

| Discount | 15% |

| Actual Purchase Price | $17 |

| Sales Price (01/20/2020) | $50 |

| No. of Shares | 100 |

| Sales Commission | $10 |

First, at the time of sale, the qualified ESPP tax rules say that you need to pay ordinary income tax on the lesser of:

- Discount offered by the company : ($20 x 15%) x 100 = $300

- The gain between the actual purchase price (with the discount applied) and the final sale price minus commission : ($50 – $17) x 100 – $10 = $3290

Since $300 is less than $3290,

Which One is Best – Qualified vs Non-qualified ESPP?

It isn’t possible to objectively rank one form of an ESPP above the other. Qualified and non-qualified can be similar, but they also diverge, and those points of difference don’t necessarily make one better than the other, they simply make them different.

From an employer perspective, the positive outcomes associated with ESPPs are broadly the same, whether qualified or non-qualified. Namely, an ESPP promotes employee ownership and will also help your retention rate.

From an employee perspective, it can generate substantial returns, which, it goes without saying, will always be attractive. Employees sometimes are attracted by an ESPP qualified plan because the tax isn’t due when they purchase their stock. Their ESPP long term capital gains can also be taxed at a lower rate.

However, a non-qualified plan offers more flexibility, but the relatively less friendly tax regime can make it a harder sell among employees on day one.

If you’ve been curious about all the benefits of ESPPs or employee ownership – or you want to understand how they can help your company specifically, contact Global Shares today. Our experts will walk you through how we can help you with ESPP management, and see which plan is best for you.

Please Note: This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.